By: Johnathan Miller

The rebound in U.S. housing and consumer spending has translated broadly to the dollar strengthening as the possibility of an earlier end to Federal Reserve stimulus measures has traders betting on higher interest rates. Employment figures are also buoying the dollar and fueling related gains in dollar-denominated assets. In the race to competitively devalue currencies, the Federal Reserve was one of the first to act with quantitative easing and asset purchases. However, with the exit date rapidly approaching on the basis of improving data, the threat of removing the monthly $85 billion in additional liquidity has the dollar soaring against peers.

The European Union meanwhile continues to struggle with the “unity” element as continued economic contraction prevents lending and growth. The possibility of an ECB interest rate cut in the first half of 2013 is rising, however the question remains about the future of deposit rate if they drop the benchmark lending rate 25 basis points. GDP and inflation figures are going to really push Mario Draghi to do “whatever it takes” to preserve the Euro.

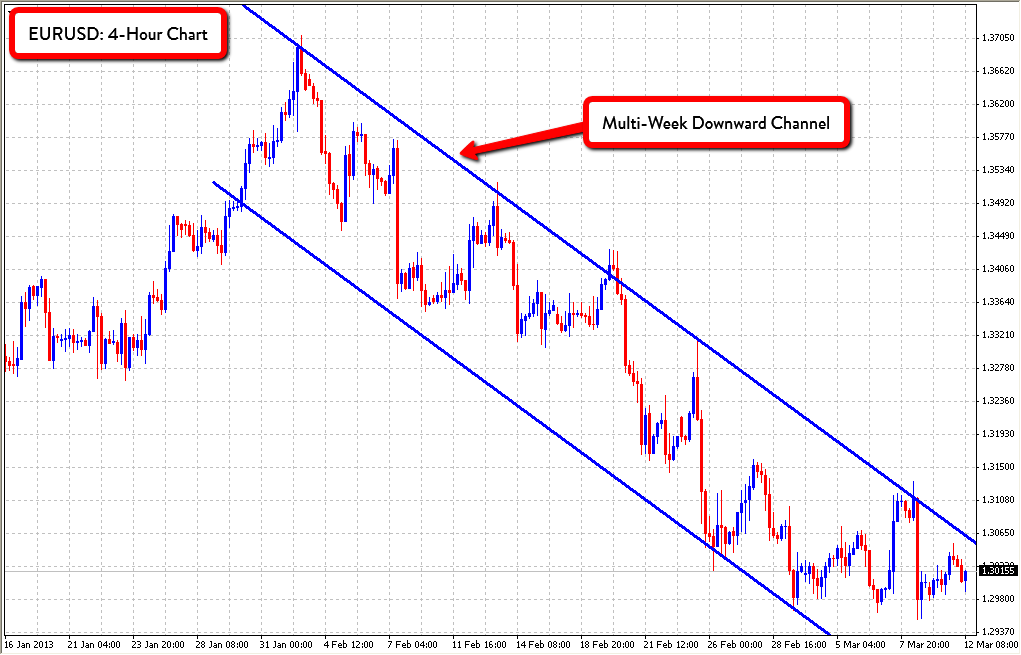

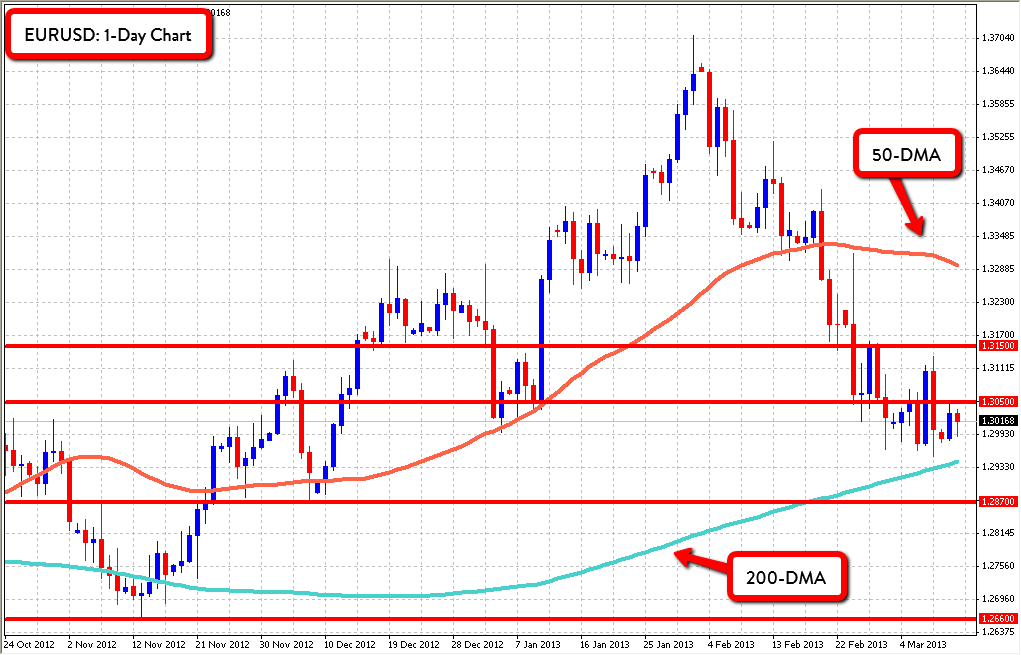

From the technical side, EURUSD remains in the multi-week downward channel as the stronger data points from the U.S. and weakening Eurozone numbers see the pair trend lower. The pair has been trading more heavily in recent weeks and recent breaks below the 1.30 handle could see the pair fall even further on the basis of technical selling. The major longer-term support level remains firmly at 1.2870 with the next major downside level sitting at 1.2660. On the upside, shorter-term resistance remains at 1.3050 and beyond at 1.3160. With the stochastic oscillator looking slightly oversold on the 1-hour chart, further selling pressure will likely be the result of poor macro data as the 50-day moving average trends to the downside and the 200-day moving average supports the pair.