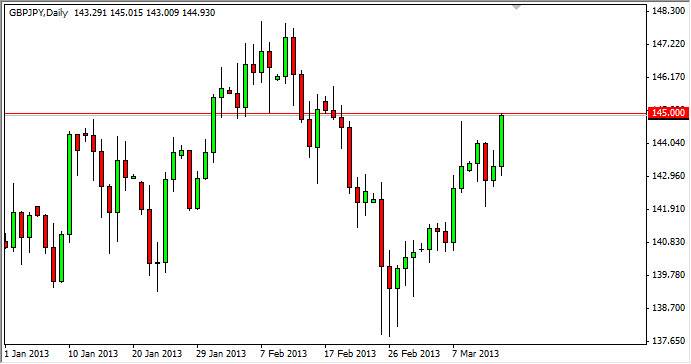

The GBP/JPY pair rose during the session on Thursday quite dramatically. In fact, the British pound did well against almost everything out there, and as a result it was one of the best days for the Pound that we have seen in what seems to be ages.

The Pound did extraordinarily well against the US dollar, which it had been sold off again so aggressively lately. This naturally translated into extreme bullishness against the Yen, driving this market towards the 145 level. This level looks to be significant resistance, but what I find interesting is that if we can get above it, we could have a fairly clear move all the way up the 148 or so.

The Bank of Japan will have a significant day today, as two of the potential nominees for deputy minister positions at the central bank will be confirmed in front of the Upper Parliament in Tokyo today. If they go through, that should open the door to easier monetary policy going forward. We already know that the Bank of Japan is looking to devalue the Yen going forward, and this would be one of the last hurdles in the way of the doves at the central bank.

145 should be significant

For me, I will wait until that vote comes in. If we can remain above the 145 handle for more than two hours, I would be convinced that we are going much higher. If that's the case, I see no reason why we shouldn't make a beeline towards the 148 handle in relatively short order. In fact, for this pair to move 300 pips in one day isn't exactly an oddity, and we could find ourselves closing this position out at the end of the day.

If we pull back from this level, I will simply ignore the pair going forward. To be honest, the British pound has suffered against most currencies recently, so it's difficult to get overly excited about taking this particular pair against the Yen depreciation. However, the technical set up is there, and as a result I do have to take this trade into consideration.