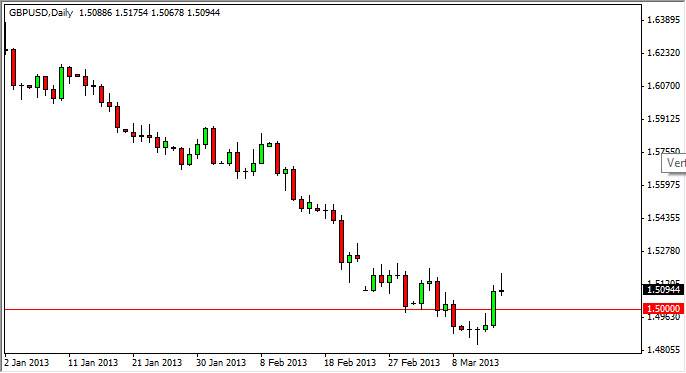

The GBP/USD pair rose during the majority of the session on Friday, only to turn back around and fall in the US afternoon session. This move was rather quick, and as a result, the markets formed a shooting star. The 1.52 level offered enough resistance to push the markets back down, showing that the reaction to the words out of Bank of England Governor Mervyn King’s mouth on Thursday was far too strong. He simply said that the “Bank of England wasn’t trying to devalue the Pound.” This caused a large amount of short covering, and as a result you see the large green candle on Thursday.

The reversal of this knee-jerk reaction makes complete sense to me. After all, the trend is most certainly down, and the 1.50-ish level of course had to cause a reaction. Also, the market should continue to have downward pressure on it as the UK economy is so weak, while the US economy is actually growing.

1.48 will open the way to lower pricing

Below, I see that the 1.48 level acted as support, and as a result I think this is the biggest hurdle for the sellers going forward. The 1.50 level should offer some support, but as we have broken through it in both directions suggests that it won’t cause too much problem. A break of the bottom of the shooting star should signal that the sellers are stepping up the pressure.

The Pound continues to look like a “sell the rallies” type of market, and every time the market bounces, I think it is an opportunity. This is actually true for the Pound against most currencies, and commodities if you find them priced in GBP.

Going forward, I think the 1.45 level will be targeted. This will be signaled by a breakdown of the 1.48 level of support, as it obviously has some buying interest at that level based upon the reaction on Thursday. The market in the meantime will continue to bounce around, waiting for more people to step in, and more news out of the UK.