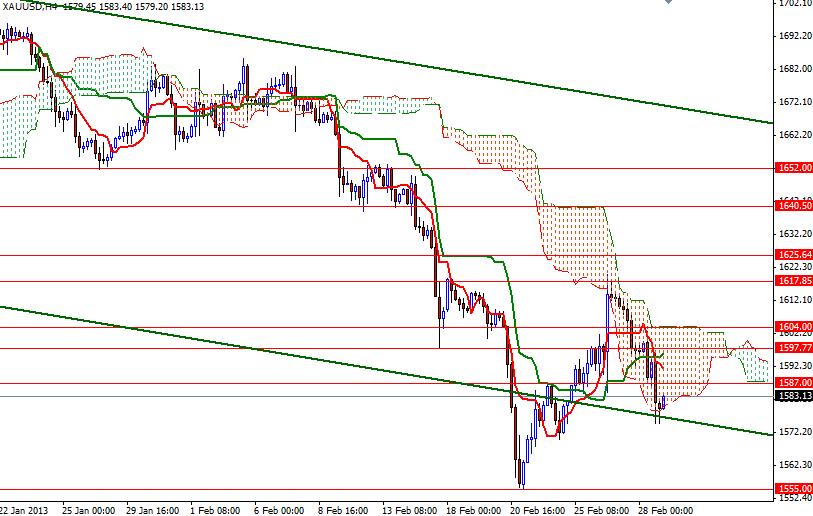

The XAU/USD pair closed lower than opening for a second day as the greenback continued to gain strength across the board after the Chicago PMI data and weekly jobless claims figures came out better than forecasts. Data released yesterday showed that Chicago Business Barometer increased to 56.8 from 55.6 and first-time jobless claims fell to 344K from 366K. As a result, the XAU/USD pair pulled back to the bottom of the trading channel which currently sits at 1575.65. So far prices remain trapped in the Ichimoku cloud on the 4-hour time frame. Since we now have a bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses on the 4-hour and daily charts, I think the key to the bearish continuation will be the 1575 level.

If we break below 1575 (it is also yesterday's low), I think the support levels at 1570, 1563.80 will be tested. A close below 1563.80 would suggest that the bears are firmly in control. If that happens, I doubt that the 1555 support will hold this time. However, if the XAU/USD pair manages to hold above the 1575 level and turns north, the first challenge will be waiting the bulls at 1587. The bulls have to climb above this level in order to ease selling pressure. Beyond 1587, resistance can be found at 1597.77 and 1604. A close above 1604 could act as confirmation that the short-term momentum is once again turning bullish.