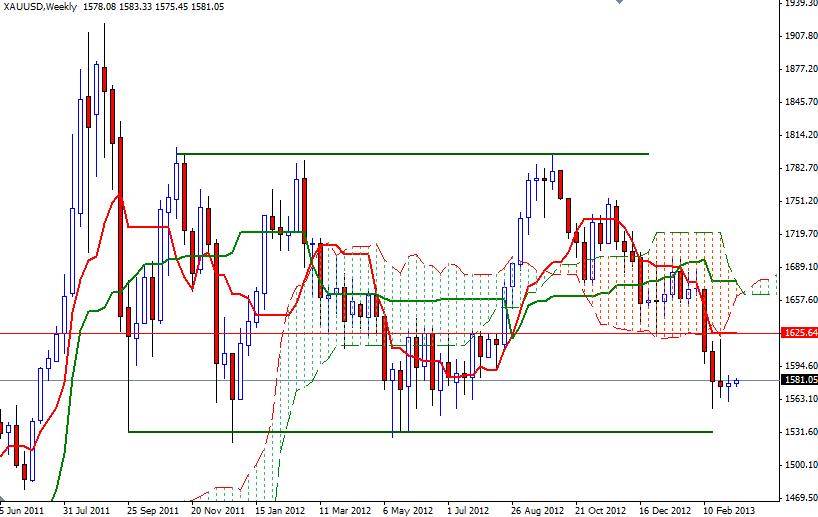

Gold prices gained some ground yesterday as speculations that the Federal Reserve will not change its aggressive easing stance in the near future increased the precious metal’s safe-haven appeal. It seems that the XAU/USD pair trying to form a bottom after 5 consecutive months of losses and as a result prices are trapped between the 1564 and 1587 levels for 7 trading days. Also note that since Friday's non-farm payrolls data, the pair has been sitting in a very tight range. I believe that we will soon reach a point where it will simply have to break one way or the other. Considering the fact that the bulls successfully defended the 1564 even after a strong U.S. jobs report, I think we will see a march towards the 1587 resistance today. Short term charts (30M and 1H) show that prices are above the Ichimoku clouds and we have bullish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses but the daily and weekly charts remain bearish.

Because of that, I will be focusing on the 1564-1587 consolidation zone and waiting a confirmation on the 4-hour time frame before I make any trading decisions. It is quite possible that the pair will continue its bullish tendencies if it can push through resistance at 1587. If that is the case, look for 1597.77, 1604. Once the pair clears 1604, more resistance will be waiting at 1625.64. But if the bears take over and the pair turns south, we could move back to 1572/0 zone. If prices drop below the 1572/0 support area, the next levels to pay attention will be 1564 and 1555. A daily close below the 1555 support level could increase speculative selling pressure.