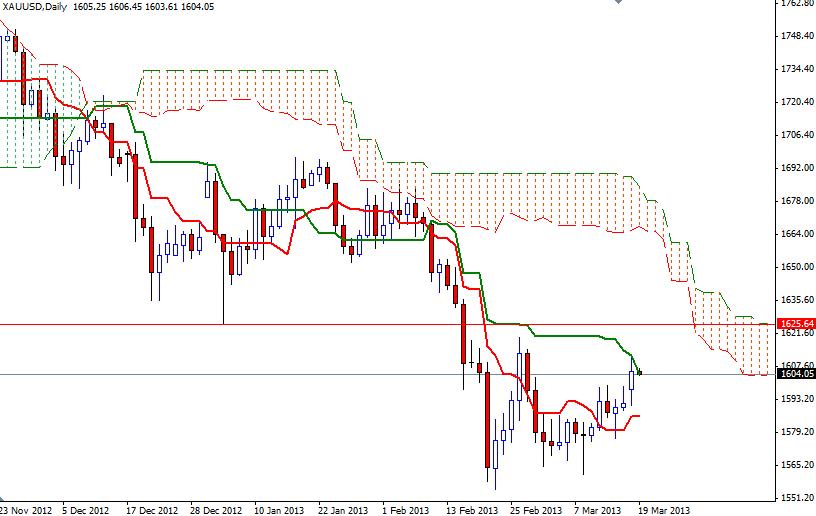

The start of the trading week saw a bullish gap as disappointment over a bailout plan for Cyprus increased desire for safe haven diversification. As a part of the plan, depositors will be required to pay a tax to contribute to the bailout. Yesterday, the XAU/USD pair (gold vs. the greenback) traded as high as 1611.11 after the eurozone's decision sparked concerns over the region's financial stability but prices retraced back to the 1604 level during the Asian session. Looking forward, market participants will turn their focus to the Federal Reserve's 2-day policy meeting which starts today. Both Ben Bernanke and Janet Yellen have been clear that the central bank will keep buying assets until the outlook for the jobs market has improved substantially (i.e. six months of jobs growth above 200K per month). Recent optimistic data fueled expectations that the central bank may back down from asset buying sooner than thought. It appears that things are moving in the right direction for the U.S. economy and eventually it will become more difficult for the Federal Reserve to maintain an excessively aggressive easing bias but I think it is a little too soon to expect a perspective change. From a technical point of view, the outlook is bullish in the near-term.

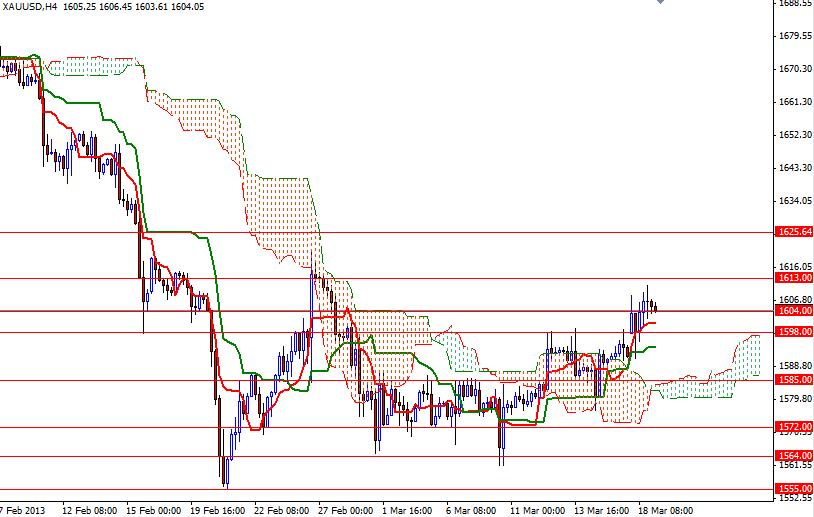

On the 4-hour chart, prices are above the Ichimoku clouds and we have bullish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses. According to the short term charts, there are and will be more strength behind the bulls as long as we trade above the 1585 level. To the upside, I expect to see some resistance at 1613 and 1625/8. 1625/8 will be a key zone to watch, as price has reversed numerous times in the past. If the bears start to dominate the pair and prices fall, expect to see support at 1598, 1585 and 1572.