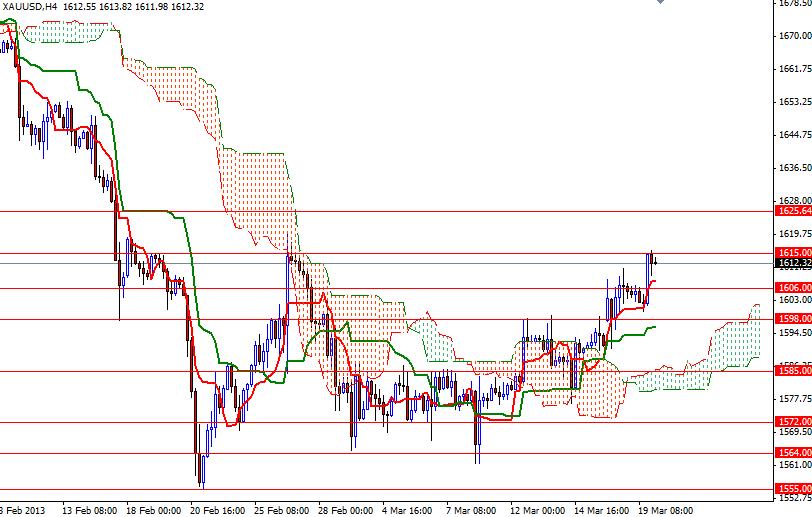

It appears that the XAU/USD pair paused its ascent during the Asian session today at the 1615 resistance level after four consecutive days of gains. Lately, there has been a constant upward pressure on the shiny metal as investors have become more anxious - especially since Italian elections. Yesterday, Cyprus's parliament rejected a bank-deposit tax needed to secure European bailout funds. The situation in eurozone is mess and the euro concept is starting to look like a failed experiment. Also uncertainties around U.S. budget talks, together with the view that the Federal Reserve will maintain loose monetary policy seem to be supportive for gold prices. Bear in mind that the Fed's policy statement will be issued at the close of its two-day meeting today. In the meantime the headlines from the eurozone will probably continue to push the XAU/USD pair higher ahead of the Fed Chairman Ben Bernanke's press conference. Technically speaking, in the near-term the XAU/USD will remain bullish unless prices drop below the Ichimoku clouds on the 4-hour time frame. However, the weekly and daily charts are still bearish. Because of that, if we continue to climb and break through the 1615 level, I believe that the 1625 will offer more resistance as it converges with the Tenkan-Sen line (nine-period moving average, red line) on the weekly time frame.

A weekly close above 1625 would increase speculative buying pressure. In that case, 1633 and 1640 might be the next possible targets for the bulls to capture. To the downside, there will obviously be support at the previous resistance levels of 1606, 1598 and 1685. Breaking below 1585 would shift things to the bears once again.