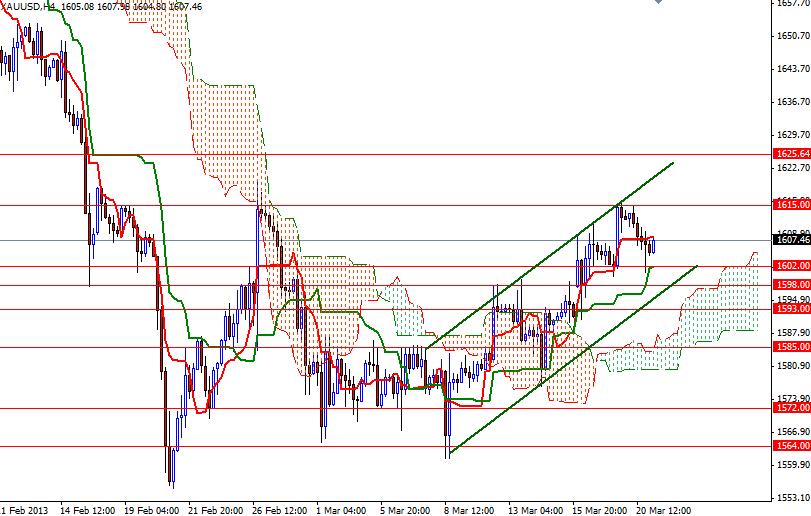

The XAU/USD pair (gold vs. the greenback) closed the day lower than opening on hopes that European Union leaders will find an alternative solution for Cyprus to restore investors' confidence once again. Yesterday the Federal Open Market Committee announced that the central bank will keep the interest rates near zero as long as unemployment remains above 6.5% and inflation is projected to be no more than 2.5%. Although the FOMC stated that the Federal Reserve will continue its $85 billion monthly asset-buying program ($40 billion of mortgage-backed securities and $45 billion of Treasury securities), Chairman Ben Bernanke said “As we make progress toward our objective, we may adjust the flow rate of purchases from month to month to appropriately calibrate the amount of accommodation. We think it makes more sense to have our policy variable, which is the rate of flow of purchases respond in a more continuous or sensitive way to changes in the outlook”. More quantitative easing might be considered as a supportive element for gold because it equates to printing money. However, this may also cause more money to flow in to the U.S. equity markets instead of gold market. Because of that I will continue to monitor the U.S. markets and USD/JPY pair. Meanwhile, it appears that the XAU/USD pair is trying to form some kind of base during the Asian session today. Prices have been following an ascending channel since March 8 and considering the fact that the pair had been bearish for the past 5 months, this reaction makes more sense. Anyway, I think it is early to tell whether we will remain in this huge consolidation zone (roughly between 1525 and 1800) which the pair has been locked in for several months or what we see is a simple retracement.

I think the XAU/USD pair will remain bullish while trading within the ascending channel, at least for the short-term. In order to gain more traction, the bulls will need to break through the 1615 resistance before challenging the bears at 1620 and 1625.64. If the bears increase the pressure, I expect to see support at 1602, 1598 and 1593. A daily close below the 1585 would confirm that the bulls are running out of steam.