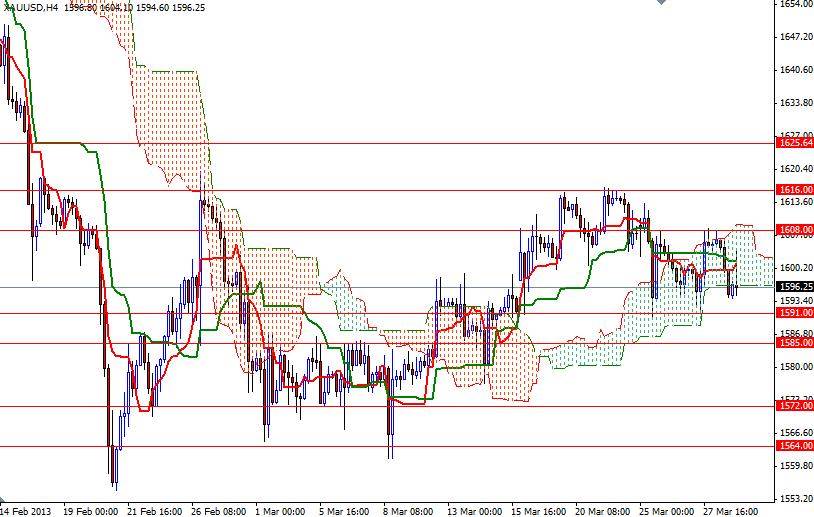

The XAU/USD pair (Gold vs. the American dollar) closed lower than opening yesterday as the bears managed to defend the 1608 level. The pair has been range bound lately and it seems that easing concerns over the Eurozone and weakening demand work against gold at the moment. Although the Federal Reserve reassured investors that it would keep supporting the economy, there is a growing expectation that the central bank will scale back its bond buying program. The U.S. economy totally addicted to quantitative easing and similar to drug addiction the economy demands for higher doses (while its impact becomes less), until the ultimate fatal overdose leads to death. Since the trend is still bearish in the bigger picture, I will be following the market. The pair has been running in a descending channel since October 5 when prices hit 1795.75 and until we break out of this channel, I will not consider going long. However, the pattern on the daily chart indicates a real lack of bearish momentum at the moment. The key level to the downside remains at the 1591 support level and a successful break of this level could give the bears the power they need to tackle the next support at 1585.

A weekly close below this level would make me think that we will probably be testing 1572 soon. If the bulls regain their strength and the pair starts to climb, look for resistance at 1608 and 1616 before reaching the same resistance level which stopped the bulls' advance several times during the last year at 1626. Don't forget that thin market conditions due to the bank holidays in major finance centers could exacerbate price movements.