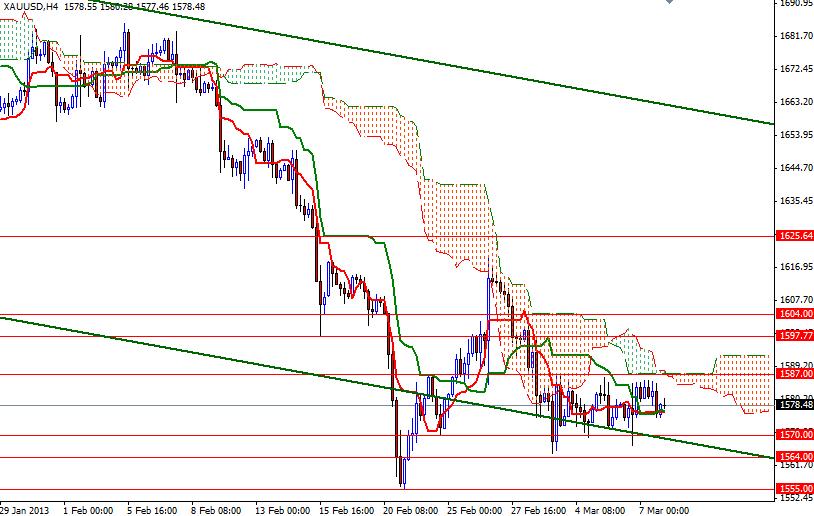

The XAU/USD pair closed the day lower than opening after the key central banks kept interest rates steady and announced no additional asset purchases. Yesterday, the European Central Bank left its interest rates unchanged at 0.75% and the Bank of England kept its benchmark interest rate on hold at 0.5%. The pair is currently trading at 1578.48, which is almost the middle line of the range that it has been stuck in lately. It seems that gold prices will continue to consolidate between the 1587 and 1570 levels and I believe that this tight range will contain the market in the short-term. On the weekly and daily charts, prices are still below the Ichimoku cloud and the Tenkan-Sen line (nine-period moving average, red line) is below the Kijun-Sen line (twenty six-day moving average, green line).

Price pattern on the charts also suggests that sentiment toward gold has shifted (compared to the last couple of years) and became more bearish. In the previous years, we had seen stronger bounces when the pair was trading these levels. Because of that, I think that there is still more room to the downside. However, I will be waiting for a confirmation first and watch 1587 and 1570 closely. Today investors' primary focus will be the release of the official U.S. jobs data which could potentially boost the U.S. dollar and send the XAU/USD lower. If the 1570 floor is breached, I think 1564, 1555 and 1547.92 support levels will be tested. If prices turn bullish and manage to break through the 1587 resistance, it is possible that the pair will head higher. Resistance to the upside can be found at 1597.77, 1604 and 1625.