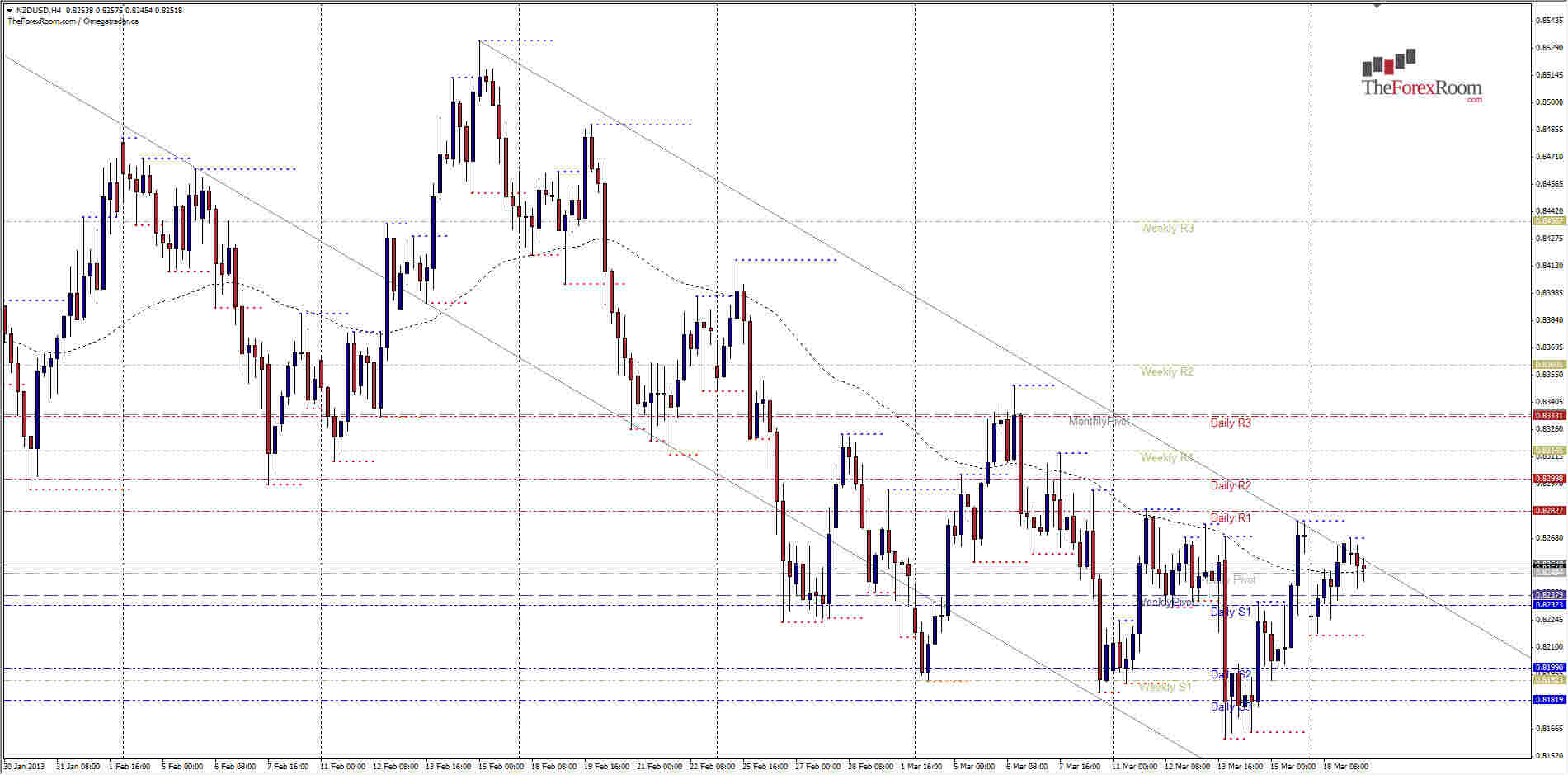

The NZD/USD (aka Kiwi) has been trading in a 4 hour descending channel since mid February when the pair broke out of its long running ascending daily channel. The pair seems to be struggling with the 0.8300 level and unable to hold price below this important support level with each lose below followed by a correction right back above it within hours in most cases. Currently trading at 0.8253, and testing the top of the descending channel, will this be the day that the bears rally finally see's sustainable results? Or, like its cousin the AUD/USD, will it strengthen its resolve and push back higher? If the channel holds, we should see the pair fall and encounter support at the Daily S1 which sits within 20 pips of the Weekly pivot at 0.8223, and then mid way down the channel sits the Weekly S1 and last week's lows around 0.8192 before making a run for the bottom of the channel at 0.8115 and the Weekly S2. To the top side we have last week's highs and the Daily R1 at 0.8283 before running into the Weekly R1 at 0.8315 and Monthly Pivot at 0.8331. This will be the tipping point for the bulls, if prices close above 0.8331 we could then see price fall back inside the rising daily channel and make a run for 0.8500 rather quickly.

Kiwi Channel Holds - Mar. 19, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- NZD/USD