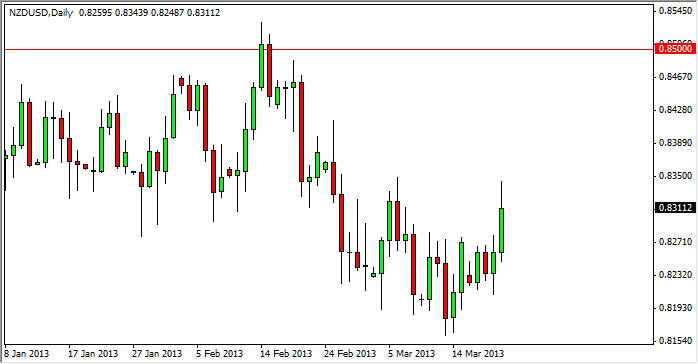

The NZD/USD pair had a strong showing during the session on Thursday, as we reached all the way up towards the 0.8350 resistance level. This area was previously significant support, so the fact that it offers resistance now really is a surprise. The pullback in the afternoon was relatively significant, as we shaved to roughly 40 pips off of the gains, but in the big scheme of things, wasn't exactly a meltdown.

This market has quite a bit in the way of support resistance, and there are minor levels everywhere. This is what makes this bullish candle so interesting to me, because it didn't break through one or two minor areas, something that had kept me out of this market previously. The biggest problem though is the fact that the downside has an absolute minefield of support below, as it seems to appear every 25 or so pips in some places.

Because of all that, I actually believe that I would prefer to buy this pair. However, it's going to be very difficult to do so at this moment. I recognize the 0.8350 level as significant resistance, and as a result the fact that we touched it was nice, but not quite enough to get me to start buying yet. However, that was a level that I've talked about previously, and have stated it is an area that needs to be cleared in order for me to go long. There is the possibility that the candle on Thursday was an attempt to do just that, clear the way.

Watch the commodity markets

During the Thursday session, the commodity markets were relatively weak, with the exception of precious metals. While the New Zealand dollar will move with the overall risk attitude of the commodity markets, the truth is that New Zealand is more of an agricultural exporter than anything else. Is because of this that I actually believe a breakout by the New Zealand dollar is more than likely going to be a signal that you want to own the Australian dollar. This is because the gold markets have finally woken up during the last couple of sessions, and as a result the Aussie should outperform.