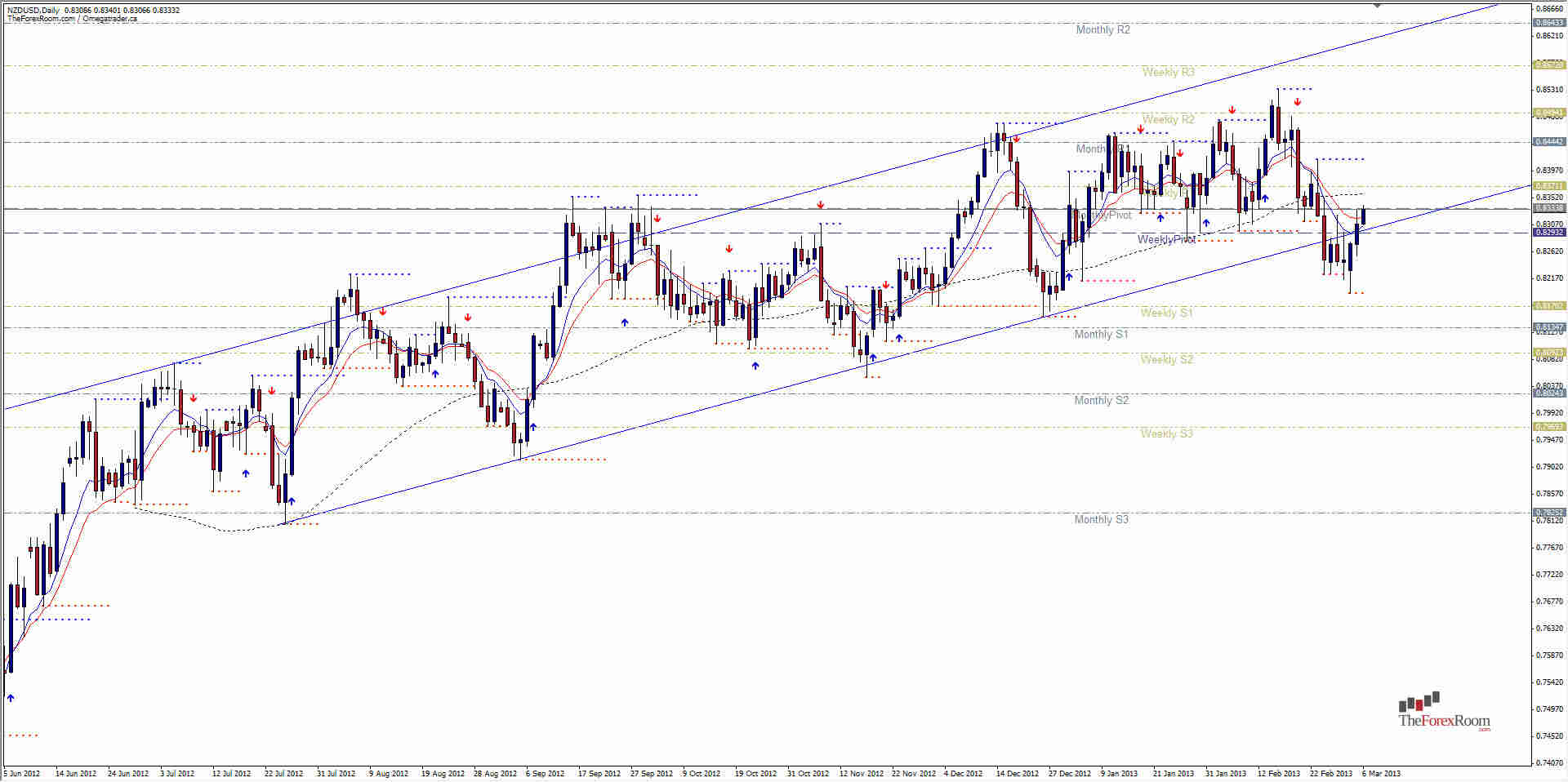

The Kiwi (NZD/USD) has re-entered the ascending channel that it has been trading in since July 2012 after a brief hiatus to the downside, and apparently unsuccessful rally by the bears. The pair is bullish for the third day in a row after reaching a low of 0.8192 (a 3 month low). The pair now faces resistance at the current price level of 0.8340 which was more or less the floor for most of 2013 and the 62 day moving average just ahead at 0.8360. A close above 0.8370 could see the pair run once again for the top of the channel which now intersects with the Monthly R2 at 0.8643. that's a long way off and there will be other challenges for the bulls at 0.8415 (Feb 25 high) and 0.8460 (January High). If the resistance at 0.8340 holds and the bears take over again, look for support at 0.8267 (November high) and 0.8213 (January Low) with a Weekly S1 residing at 0.8170 that coincides with highs and lows as far back as August last year. Overall this pair is quite bullish, and seems to go up much smoother than it comes down.

NZD/USD Rebounds From 3 Month Low

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- NZD/USD