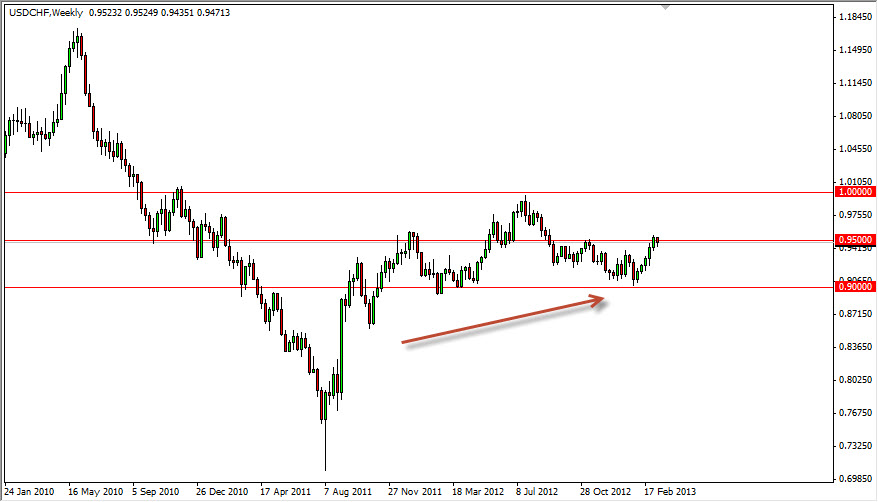

The USD/CHF pair has recently been bullish, bouncing from the 0.90 handle. It currently is trading roughly at 0.95, and as I write this it looks like we are trying to breakout. Personally, I believe that we are looking at a nice consolidation area between 0.90, and the parity level. Going forward, it does appear that the US dollar will continue to appreciate against the Swiss franc. With that being said, I see aptly no reason why we should reach parity some time during the second quarter of 2013.

The Swiss National Bank has been working against the value of the Franc over the last couple of years, although mainly against the Euro. However, this has had an effect on whether or not the Franc could continue to appreciate against various currencies. It's a bit of a knock on effect, and although it isn't necessarily on purpose, it does tend to affect currency rates vis-à-vis Switzerland around the world.

Whether or not we can get above the parity level is a completely different question. I don't think that we will necessarily break above the parity level during the quarter, but it's very possible later this year we see that happen. This is a pair that tends to chop around quite a bit, and I don't see any reason why that will be any different. The last five candles before the week that I am writing this during have all been positive, so little bit of a pullback would be a surprise. Quite frankly though, I believe that buying the Dollar on dips will be the way to go for at least the next few months. In fact, I believe that the Dollar continues to strengthen overall against most currencies, for at least the next three months.

If you are going to trade this pair, keep in mind that it does tend to move a bit slower than some of the other majors, and as a result it does take patience. This is more of a long-term traders market, and as a result it takes the ability to simply place your trade in what way. However, this pair tends to be very technical, probably more so than most. With that being the case, it's very easy to put on a long-term trade as a bad we may only have you down something like 75 pips. Going forward, I do believe that we will see parity in this pair during the quarter.