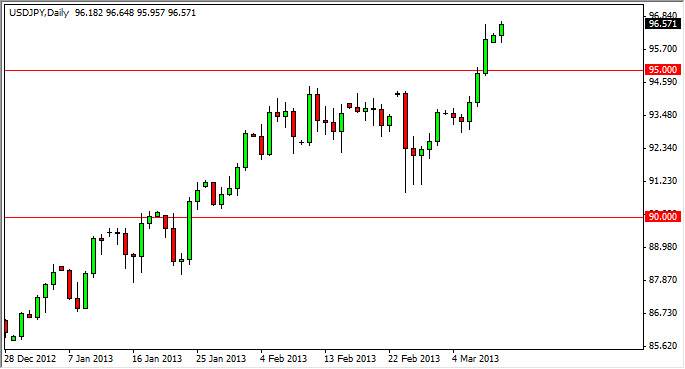

The USD/JPY pair has been squarely in the sights of almost all forex traders over the last few months. The action that we have seen over the last couple of days will have done very little to change that fact. The action seems to be up, up, and away under almost all conditions, and as a result it has been difficult to get long at times because of the parabolic nature of this move.

However, there are several things that have me fairly comfortable buy this market. After all, the Chairman of the Federal Reserve recently stated that he “fully supported” the actions of the Bank of Japan, so a “currency war” between the two central banks seems very unlikely. The banks are both trying to ease their monetary policies, essentially trying to weaken the value of their respective currencies.

The “green light” given to the BoJ in public by Bernanke will almost undoubtedly make the Japanese much more comfortable in working against the Yen, especially against the Dollar. The pair should continue to be a “one-way” ride higher, with the occasional pullback on the way to at least 100, and more than likely much, much higher.

Long-term Trend

The long-term trend in this pair has certainly changed. However, there will be some people out there that think they have to short this pair every time it looks like the market is going to pull back. The pair should however be a good “buy on the dips” pair for the next few years. The market has a long history of trending, and as a result we could find ourselves in a market much like the one that we saw before the housing crash in America. In fact, it used to be as simple as buying Dollars, and selling Yen.

The 95 level below will continue to offer support, and extend down to the 94.50 level. I think that buying pullbacks to that level is almost a “no-brainer.” I also think that simply being patient in this market will continue to be paramount, but in the end buying this pair over and over is the way to go for the foreseeable future.