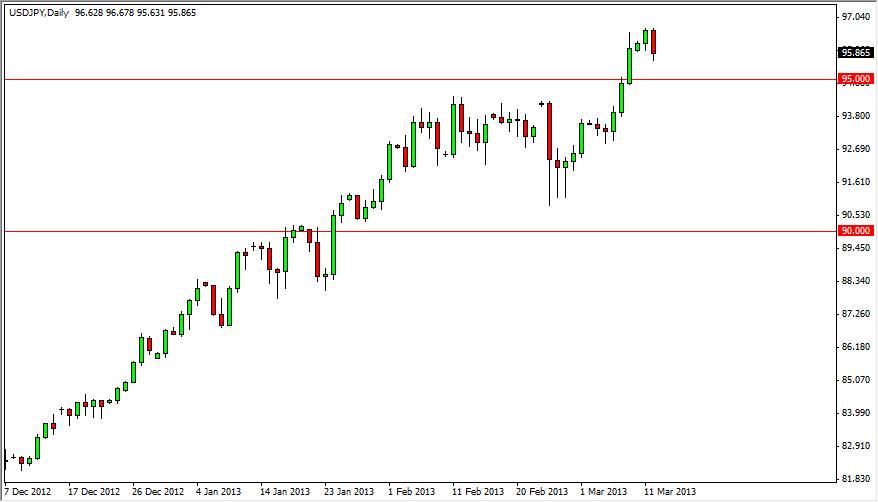

The USD/JPY pair fell during the session on Tuesday, breaking below the 96 handle. This would have been a little bit more impressive, have the 96 handle managed to form some type of pedigree, but as we recently have just broke over it, there isn't a whole lot you can read into this. However, the 95 handle has a longer history of being an area where price reacts. With that being the case, a pullback to that level will become much more interesting for me as a trader.

Looking at the 95 handle, I see a supportive, but I also see support going all the way down to the 94.50 area. Because of this, it looks like a "thick support zone", and I would be much easier on accuracy as far as candle shapes are concerned. I believe that the overall trend is certainly to the upside, and will continue to be for several years. Is because of this that I am willing to give my stop losses much more room than usual.

Bank of Japan

The Bank of Japan continues to work against the value of the Yen, and even have an unlikely ally in this: Ben Bernanke. During congressional testimony lately, the Federal Reserve Chairman suggested that he was "completely behind the Bank of Japan in their attempt to inflate the Japanese economy", and as a result it appears that the Americans are going to be perfectly fine with this currency pair appreciating over time. At this point, one would have to speculate that as long as the uptrend doesn't turn into a parabolic move again, both central banks will probably be perfectly fine with that.

I still believe that now that we have broken over the 95 handle, that the 100 handle will be targeted next. Ultimately, I believe we go much higher than that, and I also believe that for the next several years, I will be short the Yen most of the time. I think that any time this pair pulled back it shows the slightest inclination of support, it will be a buy.