The USD/JPY pair gapped lower at the open on Monday as news came out about the issues in the Cypriot banking system. The fact that the government was willing to tax individuals and their deposit accounts forced mass selling of risk assets. Although the US dollar is a necessarily considered "risky", this pair tends to rally when times are good, and fall when times are bad.

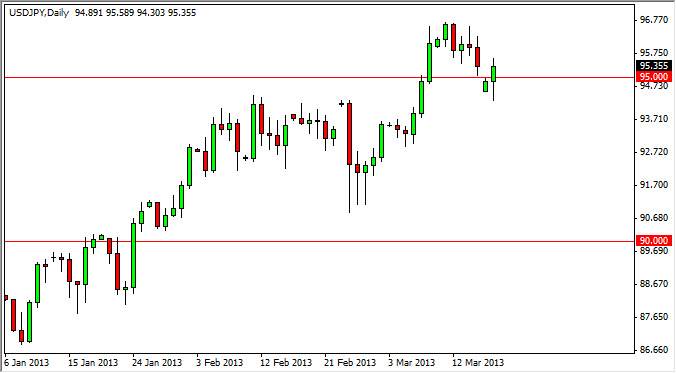

However, as you can see on the chart the market did bounce significantly and back over the 95 handle. This is interesting as the incoming central bank chief of the Bank of Japan suggested that the correct trading range of this market was between the 95 and the 100 handles. Because of this, I feel fairly confident that this hammer shaped candle at the 95 handle should be rather supportive.

I am already long of this pair, and will continue to add to it. I believe that a move higher is almost a given at this point in time, and believe that this is a longer-term trade. I think that every time this pair dips, it will be of value, and I do believe that we will eventually hit the 100 level sometime this year.

Floor in the market

The pair should have a bit of a floor in it at this point, as the 95 level has been specifically named. Also, the market wants to push this pair higher, and as a result you can only be in one direction at this point. I believe that buying this pair is going to be the way to go over the next couple of years.

The pair should continue to be supported by the Bank of Japan, and as a result I am not going to fight it. I think that the 100 barrier will be difficult to break above, but if interest rates in the US do indeed start to go higher, the 100 level will be broken. If not, we will simply see sideways markets over the next several months, but eventually the bulls will prevail.