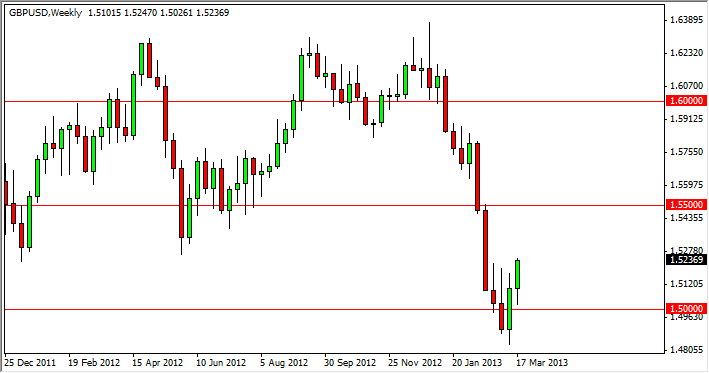

EUR/USD

The EUR/USD pair had a positive week overall, testing the bottom of the 1.30 level by the end of Friday. However, the most important developments were after the close on Friday, as the Cypriot Parliament approved measures that will make the ability to accept the EU/IMF bailout package a reality. Because of this, there very well could be a gap higher on Monday, and a move higher could be possible. Guess what? That should clear to docket for the market to start focusing on the Italians and their lack of a governing coalition. I expect to see a lot of choppiness this week, and quite frankly will more than likely fade rallies.

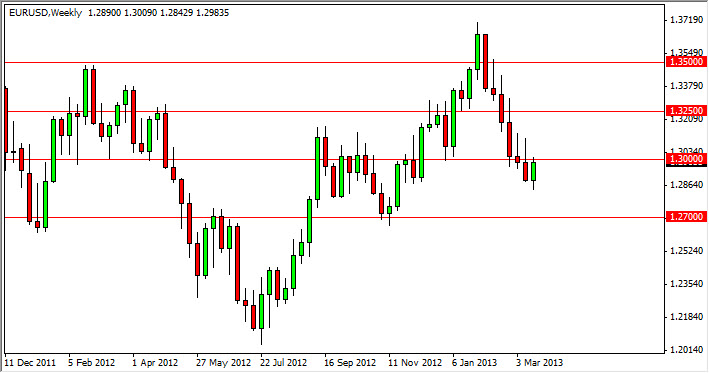

AUD/USD

The AUD/USD pair broke above the 1.04 level, which is an important area for the pair. This was the “middle line” for the larger consolidation level. The larger picture suggests that we are heading towards the top of the major consolidation, and therefore the 1.06 level. This also lines up with the fact that gold has broken out to the upside, and is now enjoying support at the $1,600 level.

This pair could really take off if we could get above the 1.06 level, as the measured move suggested by the rectangle could see the AUD/USD pair going as high as 1.10 in the end. I would expect that gold will be a major influence as to whether or not that can happen.

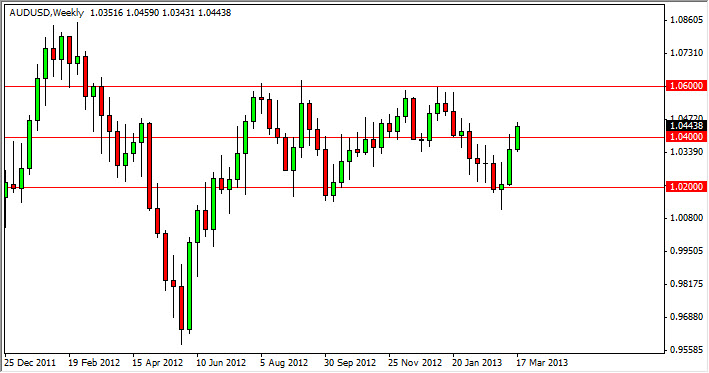

USD/JPY

The pair fell below the 95 handle at the end of the week. However, there will be somewhat of an automatic bid in this market as the Bank of Japan should continue to work against the value of the Yen in general. The support area of the 95 handle actually goes as low as 94 in my opinion, and I also think that the pair will be supported overall as the market continues to be reminded of the Japanese stance on their currency.

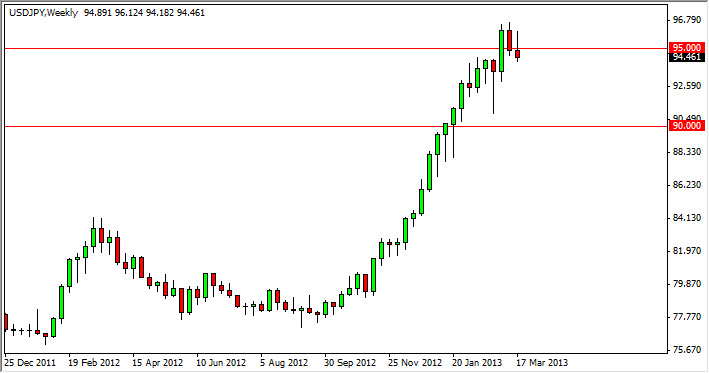

GBP/USD

The GBP/USD pair had a solid performance during the previous week for the first time in what seems like ages. The 1.53 level is very important for me, as I see it as the top of the shooting star that broke down to make the gap. If that level gets taken out, there is a good chance we see the 1.55 level challenged. Ultimately, I will be looking for rallies to fade on the first signs of weakness. Overall, there are far too many reasons to expect the Pound to weaken over time.