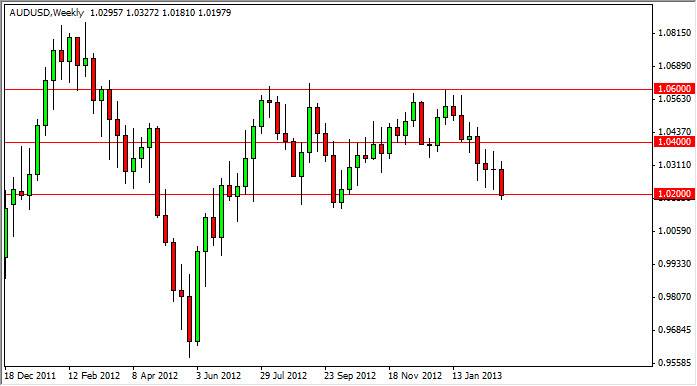

GBP/USD

At this rate, the Pound looks like it is in serious trouble. We have seen this market fall apart over the last couple of weeks, and it appears that there is more pain on the way. The candle for the previous week is a shooting star, and it suggests that there is probably more downside in the future. I see the 1.50 level as being supportive, but if the market falls below the 1.4950 level – we could see a significant fall at that point.

The Pound is going to continue to be pummeled. The market could get a bit of a bounce at this point, but if that happens – there should be nice selling opportunities above. The US Dollar Index has broken out, and it now appears that USD is going to strengthen even more.

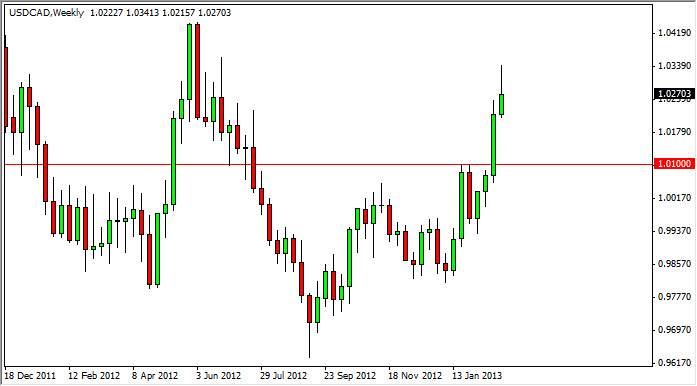

USD/CAD

The USD/CAD pair had a good series of sessions over the last week, breaking above the 1.03 level. The pair pulled back a bit towards the end of the week though, and as a result the market formed a shooting star. The shooting star doesn’t necessarily suggest a meltdown to me, rather a pullback. I think this pair will need to retest the 1.01 level, or somewhere near that, as support. The pair broke out above that level in order to start this surge higher, and as a result the resistance should now be support. We will see.

EUR/USD

The EUR/USD pair fell during the week as well, showing the underlying strength of the US dollar. The 1.30 level has held as support, and as a result the market is sitting on top of significant support below. The market sees a lot of “noise” below this handle, and the mess extends down to the 1.27 level. The pair could fall form here, but to be honest – I think that a bounce could be coming. This of course depends on Italy not throwing the world into financial chaos.

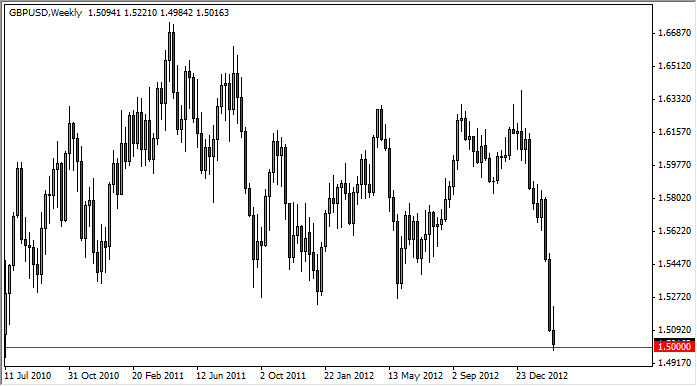

AUD/USD

The AUD/USD pair fell over the course of the week, testing the 1.02 level as support. This is an interesting area in this pair, as a break lower could be fairly strong. The 1.0150 level looks as if it is the “bottom” of support. If we get a daily close below that, this market could really fall off a cliff. At that point, I couldn’t possibly be short enough of this pair.