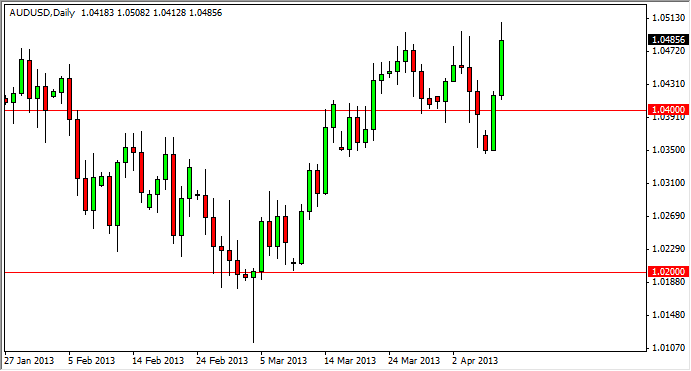

The AUD/USD pair had a strong showing on Tuesday, breaking all the way up to the 1.05 level again. However, by the end of the session we did pullback a little bit as the 1.05 level offered far too much resistance. The biggest problem with this bullish move is that it all happened in one day and therefore I can't necessarily take advantage of it. This is mainly because of the fact that I've seen so much noise above 1.05, and think that the real launching point will be at the 1.06 handle.

Looking at this chart on the longer-term timeframe, you can see a clear consolidation area between the 1.02 level on the bottom, and the 1.06 level on the top. I have the 1.04 level marked on the chart as it is considered "fair value" at this point time, and has been for roughly 18 months. The Aussie generally does well with a stronger gold market, and we did in fact see the gold markets perk up a bit during the Tuesday session. Is because of this that I think we may eventually see this pair breakout above the 1.06 handle.

Federal Reserve

You simply cannot ignore the fact that the Federal Reserve is out there printing currency as well. Because of this, we could see a move into gold and into the Australian dollar as the markets continue to inflate. While this has not been the case most of this year, gold is in fact near a very massive support zone, and as a result we could see the market continued to climb from present levels.

As far as selling is concerned, the Australian dollar simply cannot be sold. There are far too many minor support levels going all the way down to the 1.02 level, and possibly parity for us to be involved on the short side. It just simply doesn't make sense, so any massive pullback will more than likely offer a buying opportunity. The parity level would have to be broken in order for me to get bearish on the Aussie; although I must admit I'm not overly bullish either. Ultimately, if we get above the 1.06 level, the consolidation move measures a target of 1.10 on the upside.