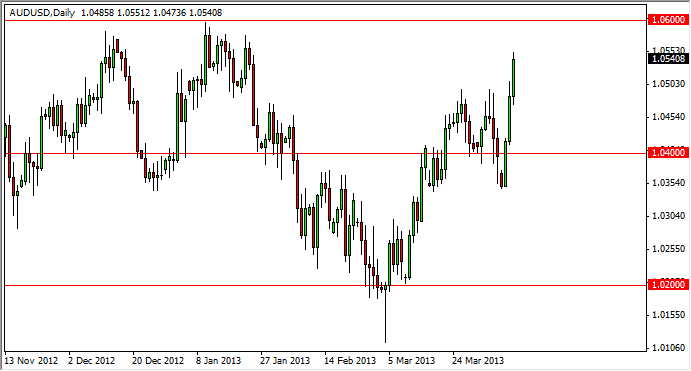

The AUD/USD pair shot straight up during the session on Wednesday, showing strength yet again from third session in a row. As you can see, we are approaching the 1.0550 level at the close, and this of course is a very bullish sign. However, I have certain reservations about this pair breakdown at this point, mainly having to do more with momentum than anything else.

As you can see on the chart, I have reread lines representing supporting resistance areas. The 1.06 level continues to look very resistive to me, and I believe it is the top of a larger consolidation area that we've seen form over the last 18 months or so. Looking at this chart, a break above the 1.06 level could be measured all the way back down to the 1.02 level, and project out for a target of 1.10 by the time the upward momentum should turn back around.

Alternately, I think that the market will more than likely struggle up at these highs, simply because there is so much resistance up here. Nonetheless, this market has shown significant resilience to get back up to the general vicinity to begin with. If you look at the chart however, must be said that I see the potential for head and shoulders - the inverse kind - being formed at the moment.

Aussie strength

All things being equal, I will not sell the Australian dollar. Even if we see some type of pullback, I think that it's far wiser to simply wait for that pullback to stabilize, and start buying again. The fact that we have continue to levitate in this area even in a somewhat pro-Dollar marketplace, says quite a bit to me.

Gold will certainly have an effect on this pair as well, as Australia is the world's largest exporter of it. The gold markets have recently been hammered, so that correlation may or may not give you a hint as to when the pair wants to breakout. As long as gold can hang above the $1500 level, I think this pair has a significant chance of going much higher. I won't buy into we get a daily close above the 1.06 handle though, were some type of significant pullback that shows signs of support.