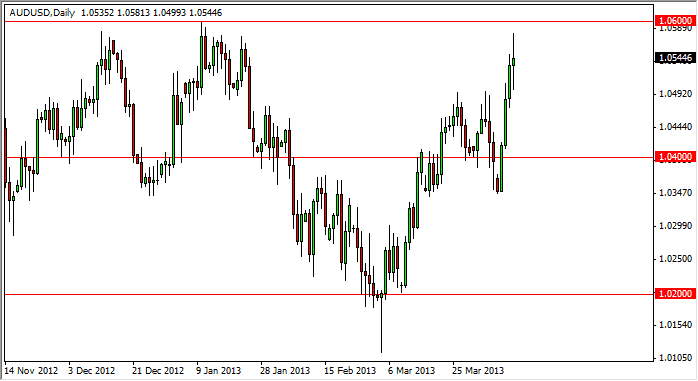

AUD/USD had an interesting day as it went back and forth during the Thursday session. As you can see, we went as high as 1.0580, and as low as the 1.05 handle. This tells me that the market is very volatile, but more importantly tells me that the market wants to go higher. With that being the case, I definitely thinking of buying the Australian dollar, but there are a few things that I need to see first.

One thing that would certainly help, would be to see the gold market pick up a little bit. It has started to show signs of trying to form a little bit of a base, no matter what the pundits on television say. Also, earnings season being beaten in the United States certainly won't hurt either. On the other hand, if earnings season is really poor, they could signal that the Federal Reserve is going to stay on the quantitative easing bandwagon for much longer than anticipated. In a sense, until the Federal Reserve says that is going to stop printing money, the market will probably look at the "bright side" of the equation and assume that the Fed is going to keep pumping.

With that being the case, it makes sense that the US dollar will depreciate over time, especially against a currency that is tied to hard money like gold, and so I think the Australian dollar has a good chance of going much higher.

1.06

If we get a daily close above the 1.06 handle, I believe firmly that this pair goes higher. I also believe that you can measure the recent consolidation area between the 1.02 level and the 1.06 level in order to get a move of 400 pips on the breakout. With that being the case, I firmly believe that this pair will reach the 1.10 level if we do breakout. It will more than likely be choppy, but quite frankly this is the trend overall as the US dollar continues its long-term decline against the Australian dollar and other commodity related currencies.