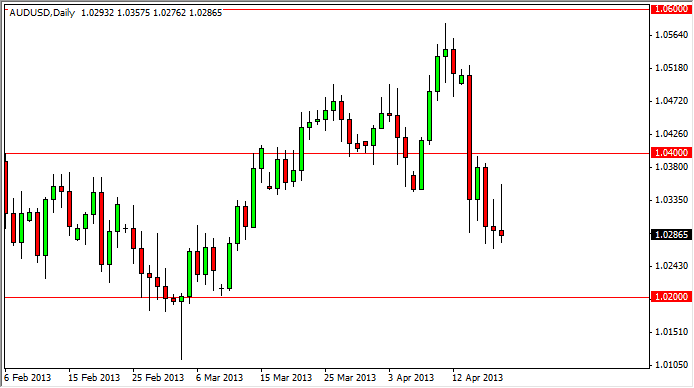

The AUD/USD pair attempted to rally during the session on Friday, reaching as high as 1.0370 or so. However, as you can see on the chart the buyers lost steam late in the day, and we formed a wicked looking shooting star. This shooting star is at the bottom of a big move down, which generally means that we will see continuation. If that's the case, I think that we will see the 1.02 handle in fairly short order. However, whether or not we can get below that level might be a completely different question.

The Australian dollar is highly correlated with the price of gold, which has been trying to find some type of base around $1400 an ounce lately. It has sold off rather drastically, but has since found its footing in the general vicinity. The question then becomes whether or not it can hold. Obviously, there are other reasons to trade the Australian dollar than simply the price of gold, but it certainly doesn't hurt if gold is working for you.

Difficult to trade

At this point in time, it's going to be difficult to short this market even though we definitely have the set up. That's because the level below is so supportive, as it has been support for 18 months or so. In fact, I believe is sitting on the sidelines and waiting for this market fall to the 1.02 level might be the way to start buying it. On signs of support, I would certainly be interested in taking a long position as it has been so fruitful over the months.

That's the great thing about range trading; you simply continue to do it until it doesn't work. The idea course is the fact that you get more wins than losses, and in the end you make money. I will be watching for supportive candles near the 1.02 handle going forward, and would not hesitate to take them. Alternately, we could break the top of both of the shooting stars over the past two days, which I think would send this market back to the 1.05 handle.