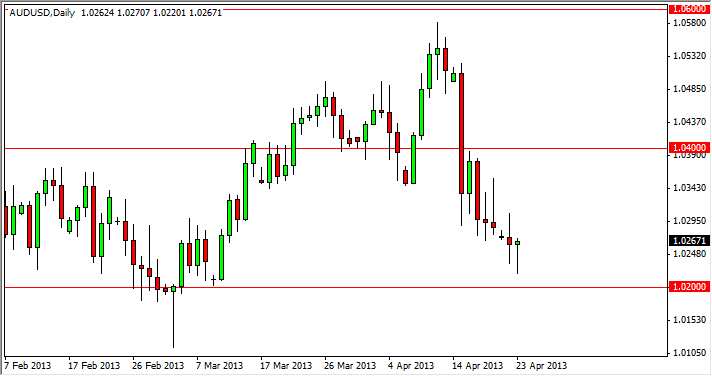

The AUD/USD pair fell during most of the session on Tuesday, but as we approached the 1.02 level, buyers stepped in to provide plenty of support. When you look at this chart from a longer-term perspective, you can see that the 1.02 level was of course the bottom of the massive consolidation area that this market has been stuck in for the last 18 months or so.

The hammer of course only put a punctuation mark on the idea that there is plenty of support here, and as a result it does look like we will see some type of bounce from this particular area. This is something that I had expected for a while, so quite frankly a break above the top of this hammer looks like an excellent buying opportunity to me. I don't know that we will see a clean move straight up, but I would not be surprised at all to see this market try to reach the 1.04 level in the short term.

Watch the gold market

The gold market looks like it's trying to find a bit of support as well and as a result this could be one of the catalysts for the Australian dollar to pick up steam. A break above the top of the range from the Tuesday candle would suggest that perhaps further pressure to the upside has entered the market. With that being the case, I think that more and more people will jump in, further making this more or less a self-fulfilling prophecy.

Looking at this chart, I think that the Australian dollar is most certainly oversold, especially considering that the Australian economy itself has been doing fairly well. The concerns about growth that Asia have more to do with the decline of the Australian dollar, but one has to wonder how much longer this can go on. I see plenty of support below current levels, and think that it isn't until we are below the 1.01 level before it's going to be easy to short this market. Going forward, I fully expect to be buying, as this area just below has been so reliable.