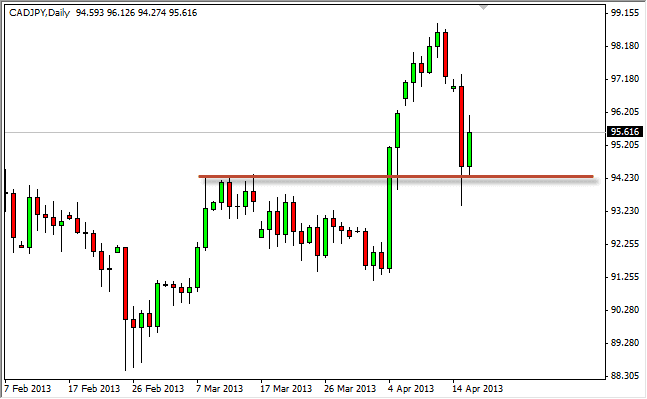

The CAD/JPY pair had an interesting session on Tuesday, as it bounced fairly significantly from the 94.25 level, and continued as high as 96.20 during the session. One of the things that makes this pair a bit more interesting than the other yen related ones for the session is the fact that there is a monetary policy meeting for the Bank of Canada later today. Because of this, the buying of the Canadian dollar would have been a bit more subdued in my opinion.

However, having said that it is obvious that the weakness in the Japanese yen continues to outweigh most other questions. While the Euro absolutely took off against the Japanese yen on Tuesday, the Canadian dollar still managed a fairly respectable gain. In this type of environment, that shows just how potentially bullish this particular market could be.

Going forward, I fully expect this pair did continue to grind higher, and eventually break above the 100 level. The Japanese yen will continue to suffer at the hands of the Bank of Japan, and it's easing of monetary policy. In fact, this will be the running theme in the Forex markets for the next couple of years. The Canadians are not trying to expand monetary policy at all, so this should continue to be a relatively good performing currency pair.

Policy statement

Will be interesting about this particular trade is that the policy statement coming out of Ottawa will be also read closely to see what's going on in America. This is because the Canadian send 85% of their exports into the United States, and if there export sector is still going well that in turn means that America should be doing fairly well. After all, the value of the Dollar can determine all of the other currencies, so understanding where America is going is a great piece of information for the average Forex trader. Alternately, if the bank of Canada seems extraordinarily dovish, this could really spook the markets as it could be read as more negative headlines coming out of the United States.