The CAD/JPY pair is one of my favorite to trade under normal circumstances. This is because the fundamental reasons that push the market are so obvious at times. As a general rule, this pair will follow the trajectory of oil as Canada exports, and Japan has to inform 100% of the petroleum it uses. As a result, you have a nice trading market to use as a proxy of the oil markets.

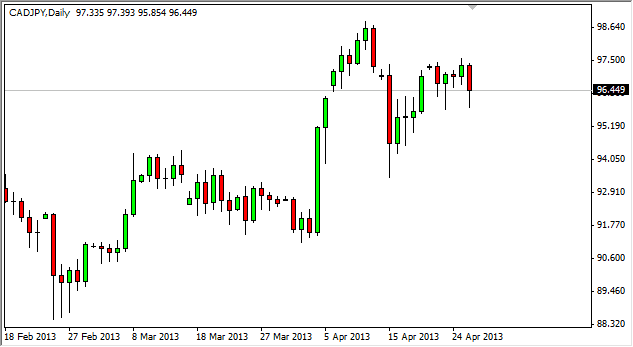

Within this chart, you can see that we lost a bit of ground during the Friday session, but that was true with all yen related pairs. I do not think that this was something do with the Canadian dollar so, quite the contrary as it strengthened against the US dollar. This is more or less a repatriation on yen back into Japan has markets entered a "risk off" vibe for the session.

Looking at this chart, I can see that we are most definitely in an uptrend, and it cannot be helped but noticed that the fall that we saw on Friday certainly was retraced. I think the fact that we got back a third of this candle suggests that there are deftly buyers down near the 95 handle. With that being the case, I think we may be looking at putting a floor into this market soon.

Bank of Japan

While this marketplace normally relies on the price of oil, it may be able to go much higher without it. This is mainly because of what the Bank of Japan is presently going to devalue the Yen. After all, a week Yen is good for export economy, but the yen has been bought hand over fist since the financial crisis. The real question is whether or not the value of the Yen is going to continue to plummet as it has recently, which of course would necessarily be too disappointing to the BoJ.

Going forward, I believe the dips will be used as buying opportunities by the bullish out there, and the selling this pair is going to be a next to impossible. I also see the 98.50 level as a significant barrier to get above, but it's only a matter time, just like in all of the other yen related pairs.