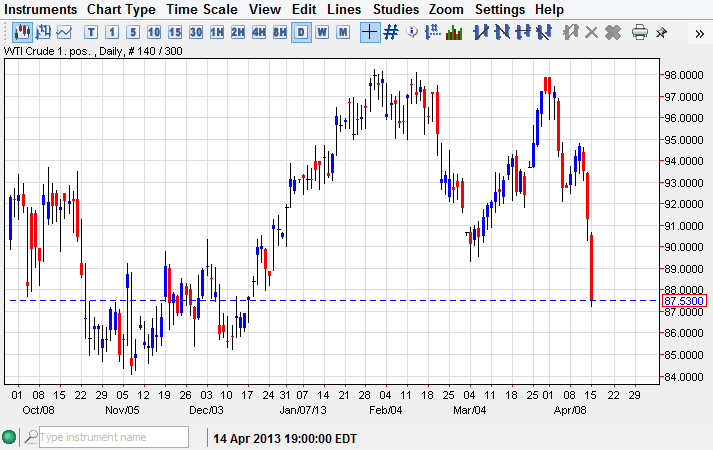

The WTI Crude Oil market had an absolutely horrific session on Monday, as we sliced through one of minor support level after another. Eventually, we found the $90.00 level, an area that should have been massive support. At the end of the day, we did not see that massive support come back into the marketplace, and any thoughts of building a range were completely blown out of the water.

As you have been reading, I thought a range was about to happen. However, it's obvious that the range is now broken, and now we have to ask serious questions about this contract. The $88.00 level is now the bottom of the recent trading action, and quite frankly I feel that we could go lower at this point. The market was relentless during the Monday session, selling off not only the oil markets, but anything related to commodities in general.

Chinese demand

Poor Chinese economic numbers early in the morning on Monday set the tone for a very negative session. The idea is that if the Chinese economy is cooling down, this means there is less demand for goods around the world. If that's the case, then there will be less demand for fuel as there will be less manufacturing. It's kind of like a chain of events that suggests that the global economy is slowing down in general. I don't find a problem with that assessment, and I am quite frankly surprised that it took this long for people to notice. The European situation is horrible, and although we are past the immediate danger, Europe is in a recession, and going to be for some time. The British aren't any better, and the Americans are barely hanging on. In that scenario, I find it very difficult to think that demand will come in for crude oil. Granted, it's not Armageddon, but we are certainly slowing down in general. How low can this market go? I don't know that answer, but I do suspect that $85.00 will offer a bit of support. Until we can close above the $92.00 level, I would sell rallies as I think there will be more weakness based upon the ferocity of the selloff.