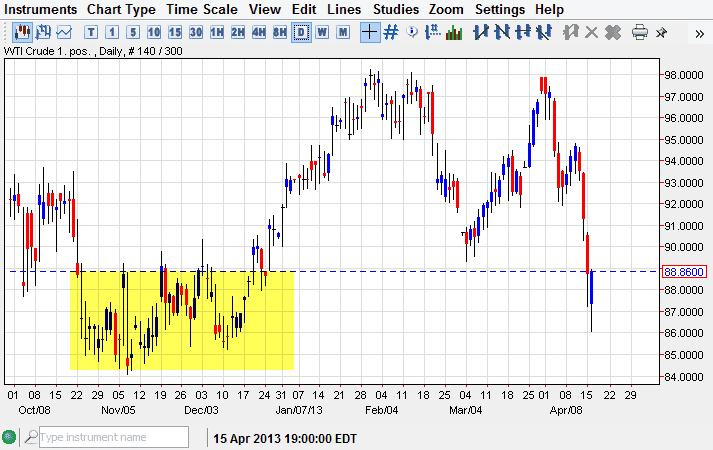

The WTI Crude market fell initially during the session on Tuesday, reaching all the way down to the $86.00 level. However, we got a significant bounce from that level, and closed just below the $89.00 level by the end of the day. This candle that I am looking at is a hammer by all means; it is at an overly extended downtrend that I find it. In other words, its right where you would like to see it placed.

I believe that the oil markets have been oversold in general. Although we don't necessarily follow Brent here, it should be said that there is a perfect hammer in Brent focusing on the $100.00 level, a major psychologically important level by all means. In other words, it looks like a market could bounce as well.

Bounce

Bounce is the all-important word in this particular circumstance. This is because I don't necessarily expect to see the beginning of some new massive bull market here, but rather I think I will see a bit of a bounce, perhaps as high as $92.00 in the short term. Because of this, the stop loss that I put into play will be fairly tight, but I do think that we have gone too far, too quickly. When you get extreme moves like this, there is almost always some type of violent reaction to it.

With that being the case, I am willing to buy on a break above the $89.00 level in this marketplace, and I am only aiming for roughly $3.00 on the trade. That is a significant enough portion to make this worthwhile while though, as the markets did a fairly well. As far as selling is concerned, I have a difficult time finding a reason to, at least until we get below the $85.00 level, which I see as very massive support. If that support level gives way, we could see a real meltdown in the oil markets. However, I find it really difficult to think that OPEC will allow that, and would start to cut production in order to raise prices.