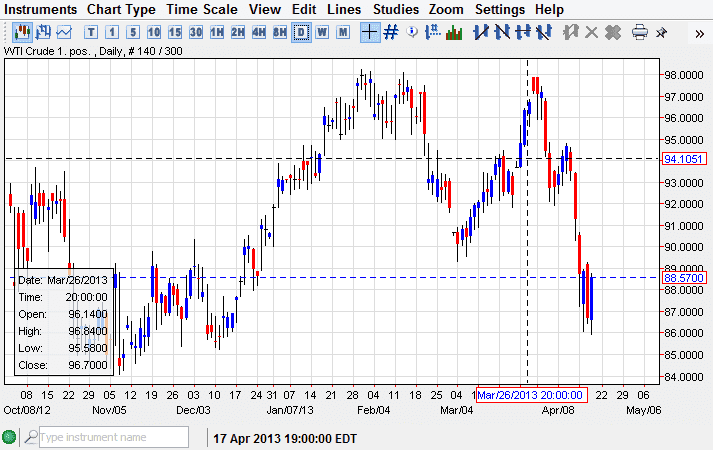

The WTI Crude market had a fairly decent bounce during the session on Thursday, as we saw the market break above the $88.00 level. However, the market is still fairly weak as far as I can tell, even though we sit on top of a relatively messy cluster that had formed way back in November of 2012.

Going forward, I think this is still a US dollar story more than anything else, and it should be stated that the US dollar still look strong overall. I think that if we get a move above the $89.00 level however, we could start buying for a small trade up to the $92.00 level where serious resistance should step back into the picture. $90.00 will also offer a bit of resistance, but in reality that is a bit more minor than the aforementioned $92.00 area.

Just below, at the $85.00 level, there is a ton of support. There is a massive symmetric triangle that is trying to form on the weekly chart, and it does in fact cross through the $85.00 area, meaning that the market should try to hold in this general vicinity. If it does not however, that would be an extraordinarily bearish sign, and have me shorting this market wildly.

OPEC

There does come a point in time though that the OPEC ministers will get involved. They've been extraordinarily quiet recently, but they typically do it just around the $80 level or so. This is also true in the Brent market, as it reaches the $90.00 level, a level that it isn't too far from at this point. Because of this the OPEC part of the equation can be ignored, and they could come into the market in cause quite a bit of headline risk. With that being the case, shorting this market might be a quick plunge, rather than some type of investment. It might pay dividends to Sibley short heavily on that break of the $85.00 level, and take your profits in a massive smash and grab. Alternately, buying that break above the $89.00 level will probably be more of a grind.