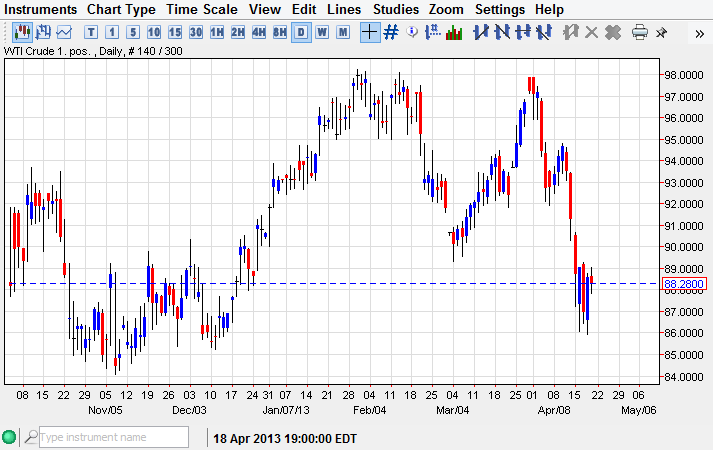

The WTI Crude market went back and forth during the session on Friday, essentially hovering around the $80.25 level. This market looks like it's trying to consolidate, probably between $89.00 level and the $86.00 level. Looking at this chart, it wouldn't surprise me to see this, because there is a large amount of noise back in November of last year right around these price levels. In the phenomenon known as this market memory, quite often support will reappear over and over at the same price.

Looking at this cluster, I think that it is significant support, and I don't know that we will fall much farther. I think $85.00 will be very supportive, and very difficult to overtaken by the sellers. With that being the case, I think that range bound traders did quite well this marketplace over the next couple of weeks if not months. Simply put, you can sell at the $89.00 level, and buy down at the $86.00 level. This of course would be predicated on the idea that this consolidation will continue, and of course eventually it will get broken out of. With that being the case, the simple playing the odds type of trade as soon as this market will remain fairly quiet for a while.

History doesn't repeat, but sometimes it rhymes.

It's very possible that we may see the same type of consolidation for a couple of months like we saw back in November and December of last year. Because of this, I think that a day trader mentality may be the way to go point forward for the foreseeable future.

However, if we get above the $89.00 level, I think that we will reach the $92.00 level before fighting significant resistance. Because of this, certainly a small long position can be had at that point. On the other hand, if we managed to break down below $86.00, I believe that the $85.00 level will also be supportive, much like a thick zone. Below there, it's hard to tell what would happen, but I suspect OPEC ministers start jawboning the market - making it very erratic.