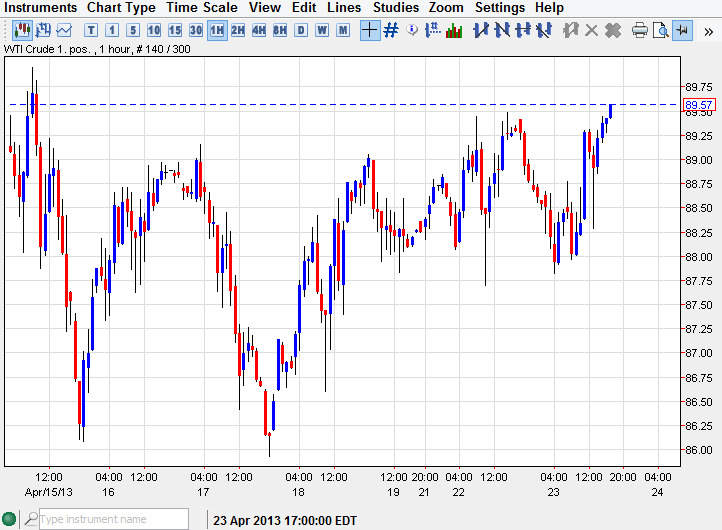

The WTI Crude market had a positive session on Tuesday, breaking above the $89.50 level. This move suggests that we are going to see continued bullishness in this marketplace, and could very well see a move to the $90.00 level over the course of the next session or two. This is also predicated upon the idea that risk assets in general look like they're getting a bit of a boost.

Looking around the marketplace, I can see that the Australian dollar looks like it's getting a bit of a boost, just as the gold markets are. I can also see that the Brent market looks like it's ready to bounce, and as a result I think there are enough antidotal reasons to think that money may flow into the commodity markets over the next day or two.

Looking forward, I think that ultimately we will find the range in this marketplace, but I've included the one hour chart in order to show that we are indeed trying to breakout. It also shows that the $90.00 level is in deep significant, and as a result should signal more buying. Up above, I see a significant amount resistance of the $92.00 level, and I think that's why this move will only last for a few sessions. In fact, I think that we may see enough resistance up at that area to start selling again.

Deflation? Who needs deflation?

One of the biggest arguments for commodities busting up is the idea of deflation in the United States and other major economies. However, the central banks are going to make sure that everything inflates out of control. By doing so, they will put a beating on fiat currencies, and as a result we could see commodities gain in general. Looking forward, I fully expect to see a lot of volatility in all commodity markets, not just this one.

We are getting fairly close to the beginning of May, and that will be a time when a lot of traders will step out. As they are on holiday, they certainly will be bothered with this market. This is why I think we are very close to finding the range for the summer. Right now I believe that we will see the $85.00 level as support, while the resistance should be somewhere closer to the $95.00 for the summer. As a result, I will probably spend quite a bit of time range trading.