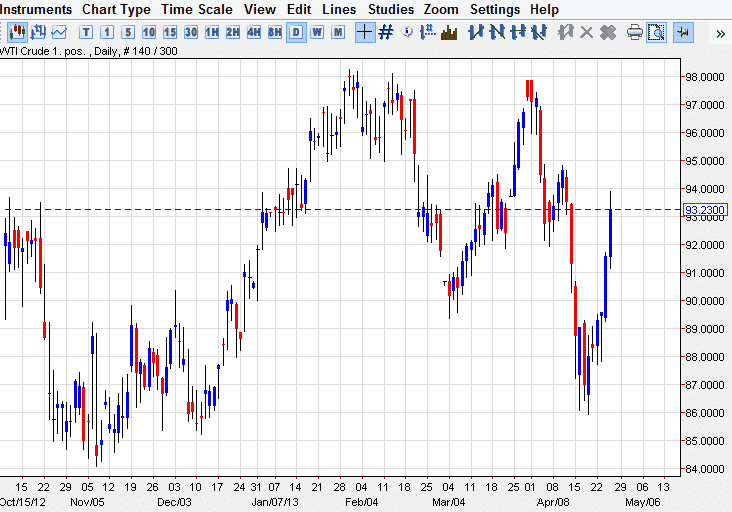

The WTI Crude market had a positive session during the Thursday trading day, as we continue to grind away higher. Quite frankly, I am surprise that we managed to break above the $92.50 level, as I suspected that would be resistive enough to keep prices away. However, we did manage to reach as high as $93.97 or so, and as a result a lot of stop losses would've been cleared out.

The candle at the end of the day is very positive, even though we did get back quite a bit. It appears now that we are simply trying to grind her way through a lot of noise and resistance, and as a result this will more than likely be a fairly choppy market. I see quite a bit of noise all the way up to the $95.00 level, and as a result am not a big fan of buying at this point. Yes, I can see that it's been positive lately, but quite frankly it's also been parabolic - something that almost begs to be pulled back.

I believe that the next candle were to on the daily chart could tell much of the story. If we get some type of resistive candle in this general vicinity, I won't hesitate to start selling this market, as I believe it is far overbought. Having said that, I think we're still trying to form some type of range for the summer, so I don't expect a huge move in either direction.

$95.00

The $95.00 handle should continue to offer resistance, but if we did managed to break above that I think this market could very easily end up testing the $98.00 handle again. If that happens, I would suspect that we couldn't go much higher, because there's really no catalyst to do so. At the end of the day, it will come down to demand. While North America does show at least some growth, this will be beneficial for this market. However, the growth is not exactly phenomenal, and as a result any bullishness should be tempered.