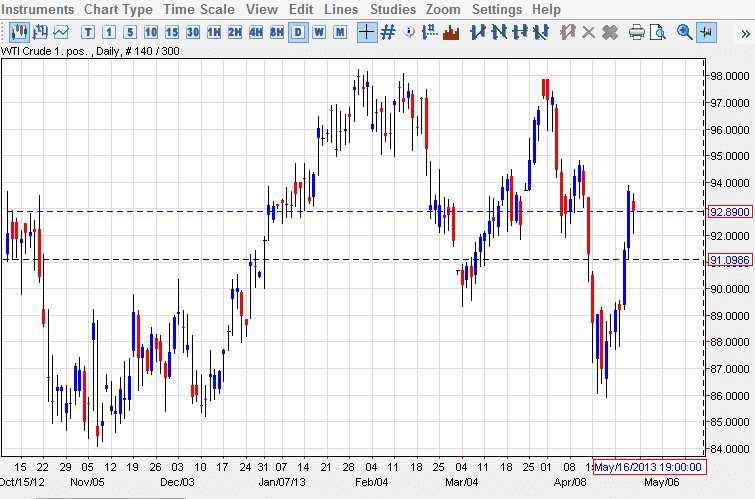

The WTI market fell during much of the session on Friday, but as you can see bounced off the $92.00 level in order to form a hammer. This hammer is placed in an area that I find very interesting as it does suggest that perhaps the $92.00 level is now trying to act as support. If that's the case, we could find ourselves stuck between $92.00 as the bottom, and the $95.00 as the top. This certainly would be a strong signal, and I believe that a break above $94.00 will certainly have this market heading towards $95.00 in very short order.

If we do manage to break the $95.00 level, I think at this point in time the market could completely break out and head straight the $98.00 in very short order. However, I do expect choppiness in this marketplace simply because of the lack of demand in some areas, and the fact that the US dollar continues to pick up steam against most other currencies overall. Sooner or later, people will equate that to what's going on in the oil markets, and it should take less dollars to buy those oil barrels.

Summer range

I still contend that we are trying to find our summer range overall. After all, we are necessarily talking about a market that tends to breakout of very strict technical standards often. The market tends to consolidate a lot, essentially at $10.00 increments, sometimes a bit smaller. This market is known for going sideways and being very technical overall, and as a result it is times like this that tend to cause the most trouble for oil traders as we simply chop around after a significant move.

Going forward, I do believe that we will more than likely try to make a move towards the $95.00 level. Whether or not we can get through that barrier is a completely different story, but I do think that eventually the markets will breakout to the upside and continue much higher. As far as selling is concerned, if we managed to break the bottom of the hammer at the $92.00 level, that would make it a "hanging man", which of course is a very bearish sign.