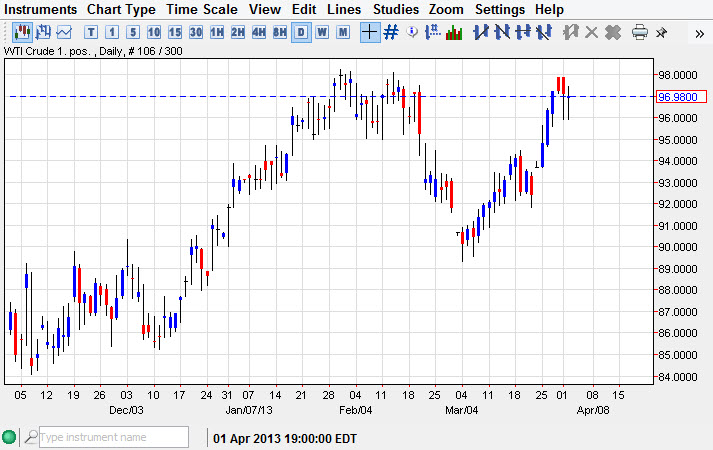

The WTI Crude Oil market had a back and forth session during the Tuesday trading hours, but as you can see ended up basically unchanged. With that in mind, I look at this chart and see that we indeed have a lot of bullish pressure underneath. The $96.00 level is certainly support, but I can also see clearly that the $98.00 level is resistance. The fact that the last couple of days have been hammer certainly doesn't hurt either, as it shows a significant amount of bullishness.

Going forward, I believe it will take a significant break above $90.00, and quite frankly $99.00 to get this market moving. I believe that we are getting close to the top of the range that we may see for spring, and possibly even summer. The market does look very bullish at this point time, but the fundamental simply do not line up with expensive oil at this point.

Watch the Dollar

It'll be interesting to see how the Dollar and the oil markets move. Traditionally, the value of the Dollar going down is normally strong for oil, as it will take for those Dollars to buy a barrel. However, lately we have seen the US dollar again while the oil markets continue to rise. This could perhaps be a play upon North American strength, but the reality is that the US economy isn't strong, it's just better than Europe.

If we managed to break the bottom of the tool hammers, and other words closing below the $96.00 level, I believe this market will break down and probably head towards at least $93.00, if not the $90.00 level. Going forward, I believe this would set up a nice range for the short term as the market churns and settles into a nice range. We are approaching that time of year where the market tends to slow down a bit, and the last three years in a row we have seen "risk off" the trend for spring. Because of this, we must be careful trading this market. I would however, be willing to buy over the $100.00 level as it would show that the market is breaking into a completely new range.