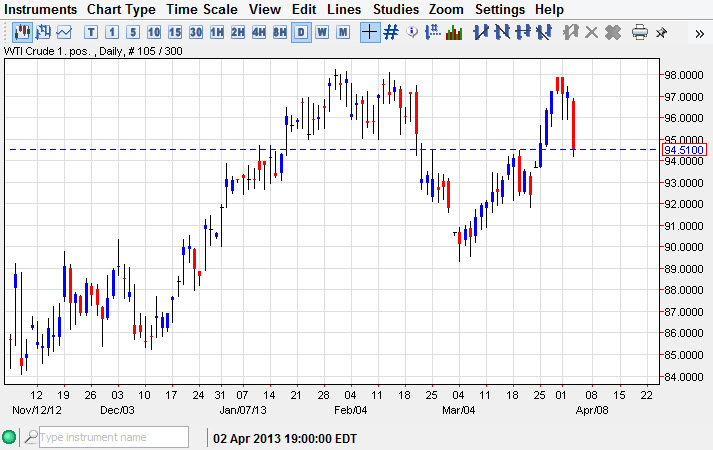

The WTI Crude market came completely undone during the Wednesday session as inventory numbers in the United States came out much larger than anticipated. Because of this, it looks like the market has been caught off-guard, and we fell immediately down towards the $94.00 level. I believe that this market will now try to find some type of range, and perhaps we will settle down into it for the spring.

The $98.00 level now looks very resistive, and is perhaps the top of that range that I have been speaking for the last several sessions. The fact that we managed to break down below the bottom of two consecutive hammers suggests that we will see continued bearishness, and as a result I would treat any rallies at this point in time with suspicion. However, we are at the $94.00 handle, and it of course looks very supportive to me. With that being the case, I would expect a little bit of a bounce, but it should to simply offer a nice selling opportunity over the course of the next couple of days.

We need stability

After a move like this, the oil markets quite often will need a couple of days to calm down. Compounding this is the fact that we have three central bank meetings on Thursday, as well as the nonfarm payroll numbers coming out on Friday. The US jobs number typically will move the oil markets quite drastically, as it gives a fairly decent read on the industrial situation in America. Obviously, if the jobs number is good, oil prices should climb as it would suggest that industry is picking back up. However, this is part of what shocked the market by the larger than expected inventory number, as it could suggest that industrial demand is falling. If that's the case, this could be very bearish for oil, but my base case still remains that we bounce around between the $90.00 level and the $98.00 level for the foreseeable future. With that being the case, I do recognize the $94.00 is the beginning of an area that will cause choppiness.