By: DailyForex.com

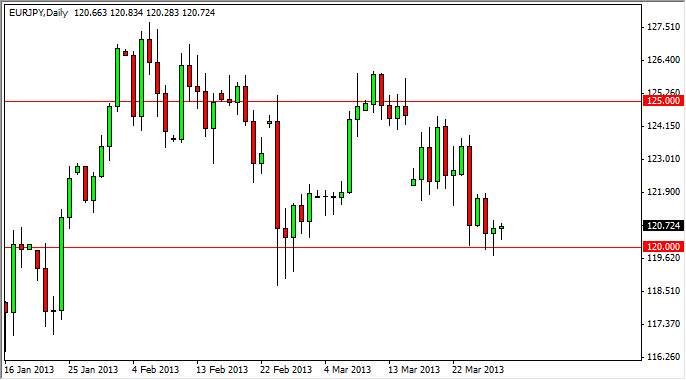

The EUR/JPY pair did almost nothing during the session on Friday, but this would have been much of a surprise considering that it was the Good Friday holiday. A lot of the liquidity wasn't there in the marketplace, but I can't help but notice that the candle shape was a hammer just like the Thursday session. It appears to me that we are trying to find support, and the 120 level is probably one of the most supportive areas on this chart from a longer-term perspective anyway. Because of this, this looks like an excellent spot to see this pair take back off to the upside.

The only tricky part about this is the fact that the Euro is involved in the trade. After all, I don't like the Euro overall, but it cannot help but look inviting with this type of set up. Also, the Bank of Japan is working against the value of the Yen, so perhaps a bounce isn't totally out of the question anyway.

For me, if we can get above the highest from the Thursday hammer, I am willing to take a long position in aim for at least 122 in the short term. Ultimately, I don't think it's much to ask for this pair to reach the 124 handle, but there could be a bit of noise at 123 as it does look like a big cluster. The cluster could cause a bit of a problem, but in reality the longer-term perspective on this chart seems to suggest that we are going higher.

Weekly chart

One of the things that I like about this chart is the fact that on the weekly timeframe, it looks like we are forming a potentially bullish flag. Not only a reforming the flag, but it suggests that we are going to see a move to the 145 handle! If that happens, needless to say this will be the trade of a lifetime in some sense.

As for selling, I don't think it's going to be easy to do until we get below the 117.50 level as I see so much noise the need this. On top of that, you have to be working against the wishes of the Bank of Japan, which I have a hard time believing will let this pair fall too far.