All through last week, the Canadian dollar held firm against the Euro after its recent losses. The losses came on the back of rumors that plans to bolster Europe’s financial system is now weakening. The Canadian government issued 10-year bonds at 1.74% with a drop of 0.05 basis points. Crude oil futures which remains the country’s major export, dropped to a month’s low of $90.93 per barrel - down by 2.9%.

The CAD sell off was a risk-off situation due to the persisting financial woes in some European countries. Fresh market trouble could be felt by the market within the week as Italy’s political uncertainty continues with no clear solution yet.

The Cyprus bailout story has also added to investors worries about a slow economic recovery for the entire Eurozone. Earlier, the Cyprus government had to refute reports that it will require non-stop financial aid from its lenders, much like Greece. The rebuttal was made based on a German news publication about discussions on Cyprus bank recapitalization to be done directly from Europe’s financial aid fund. As a result, EURCAD was squeezed down to a 4-month low for the just concluded month of April. However, Eurozone’s group of finance ministers led by Netherlands Finance Minister Jeroen Dijsselbloem gave an assurance that all is now set for the approval and release of a comprehensive rescue package for Cyprus. The €10 billion loan had earlier been agreed upon before subsequent meetings were being held by the Eurogroup to put all the details together ahead of disbursement of the funds.

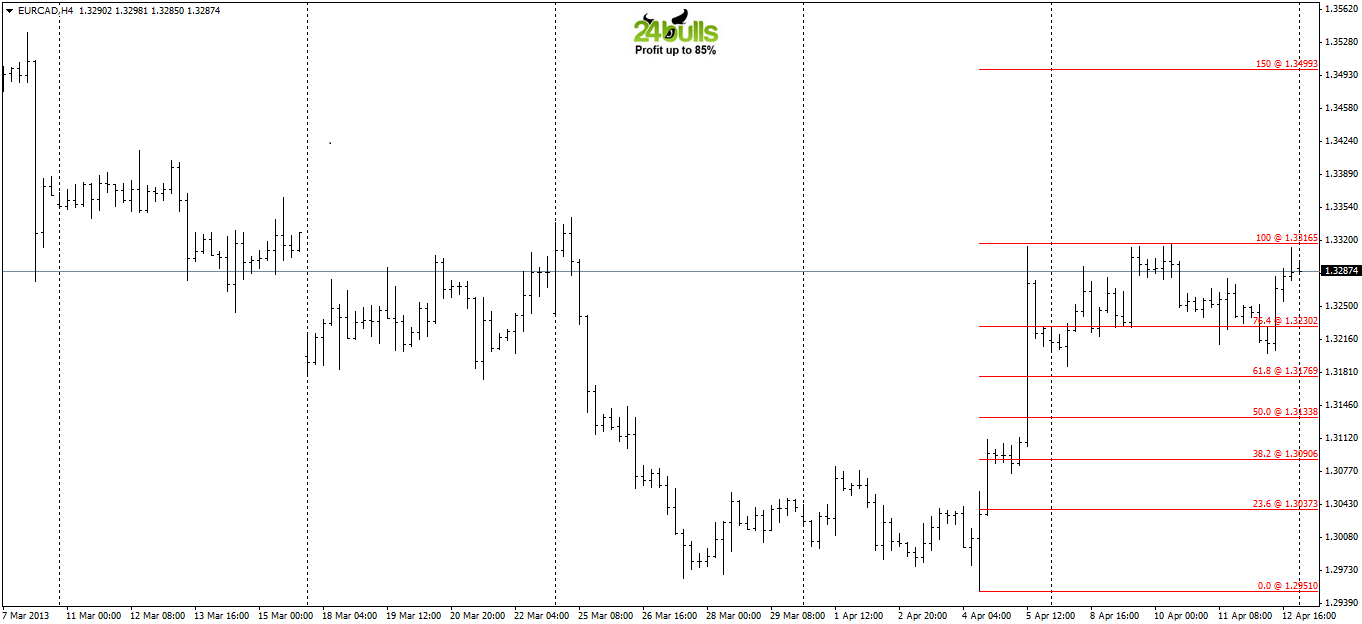

EUR/CAD has formed a triple top on the hourly chart and looks to be on course for a breakout towards the 150.0% fib level extension at 1.35. A brief retracement back to the 1.3135 area is a good buying opportunity.