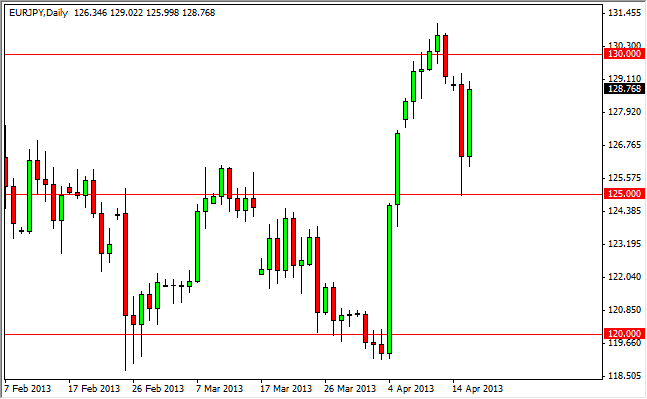

The EUR/JPY pair absolutely took off during the session on Tuesday, reclaiming almost all of the losses that we saw on Monday. This was an extraordinarily strong candle would put in that context, and as a result it's obvious that you can only buy this pair going forward. Essentially, we have proven that the market can only go one way for any length of time.

As a perfect example, you will notice how the market fell all the way down to the 125 level, and simply stopped falling. With that being said, had you paid attention to the four hour hammer that was on the chart yesterday, you could have been 300 pips richer as you read this. This market has shown extraordinarily massive and strong resilience, and as a result I think you can only buy it.

Short-term trading

Although I believe this is a long-term buy-and-hold type of situation eventually, right now I think this is more or less a short-term traders market. This is because there is going to be a bit of choppiness just above, so I am essentially waiting for this pair to pull back on a short-term chart, and simply start buying. I think this pair goes much higher than most people anticipate, and this will be one of the best performing currency pairs over the next several years.

Many of you will not have been in the marketplace to remember how this pair used to act. It used to be one of the best trading pairs for when the markets were "happy." This is because this was a "risk on" market, and as a result as stock markets around the world when higher, so this pair. This is a great way to measure risk appetite in the global markets, and as a result when times are good, I cannot think of too many pairs out there that are better to trade in this particular one.

Knowing this, it will be important to pay attention to risk appetite, and central bank policy. However, as long as the banks are overly accommodative - and although Japan's going to be for some time, this pair should continue to go higher as long as there are headline shocks to the system.