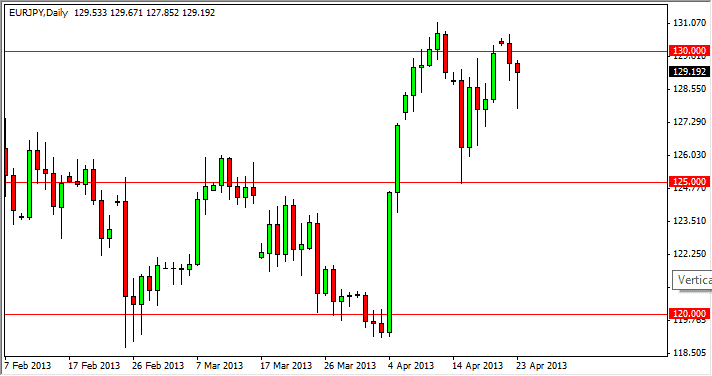

The EUR/JPY pair fell during most of the session on Tuesday, testing the 1.2750 area. However, you can see the buyers stepped back into the marketplace as you would expect, and sent this market high enough to form a fairly decent looking hammer. This hammer suggests that we are going to go higher, but obviously the 130 level is an area of resistance that will have to be dealt with. Because of this, I am looking for a daily close above that level in order to start buying again.

This market has been extraordinarily bullish lately, so a move above that level isn't necessarily asking much. However, the biggest concerns that I have to do with being whipsawed at this point. This market has been missed by a lot of different traders, so I feel that a lot of people were trying to step in any type of pullback. This is a sign of a market that has enough momentum to go much, much higher over the long-term.

Regardless, it's obvious you can't short this market. Moves like we saw back in early April don't happen every day, and they certainly mean something when they do. Because of this, I think that we will certainly see the 130 level get broken sooner or later, and I fully expect to see 135 before the end of the summer. This will be especially true if the Japanese continue their quantitative easing that they have started on.

G 20 and the Bank of Japan

The G 20 last week suggested that the Bank of Japan was simply doing what it had to do, and as a result it does not appear that other central banks around the world are going to try to stop them from devaluing the Yen. If that's the case, then this pair will almost certainly be one of the favorite vessels for people to short the Yen. This has been the case recently, and the ECB's stubbornness when it comes to cutting rates certainly will continue to push this pair higher if they sit on their hands. In the long run, this is simply a "buy only" type of market, and as a result I will have to treat it that way.