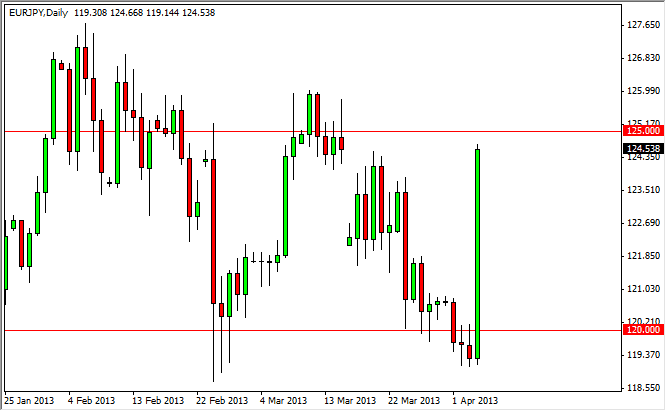

The EUR/JPY pair acted like it was fired out of a cannon on Thursday. Out of all of the Yen related pairs, this one absolutely checked out. Personally, I am actually long the NZD/JPY pair, which is doing quite well over in that market, so I cannot help but look at this chart between them. However, this is the exact type of situation that separates the amateur from the professional trader.

Quite often, people are tempted to jump into a market that's acted like this. I certainly understand that thought process, but considering the fact that we are 500 pips above where we started for the Thursday session, it's very difficult to justify getting involved now. Simply put, we absolutely positively need to see some type of pullback in order to start buying this pair.

With the Bank of Japan adding even more stimulus during the session on Thursday, it's now obvious that you simply cannot short the Yen related pairs. However, I am sure that there are people out there jumping in this pair right now as we speak. The biggest problem of course is the fact that the 125 handle as such obvious resistance. When the pair shoots straight up or down like this one has, it's hard to keep up that kind of momentum to break through a significant support or resistance barrier. That's not to say can happen, but it's a lot like trying to break down a door, quite often you are better off to use one solid kick then to run from a mile away, as you simply run out of momentum. By the time you get there, you're exhausted. This happens quite often with these types of moves.

Pullback

I am personally waiting for a pullback, because I believe we do break through the 125 barrier. However, I am aware the fact that we could just simply go through it. If we do, above the 126 handle I'm willing to start buying again. However, as we have cleared 500 pips in one day, it's very difficult for me to think that this pair will continue like this over the next 24 hours. Alternately, the nonfarm payroll number could shocked the market enough to cause some type of major pullback, which of course I'll be waiting for so that I can buy on the for signs of support.