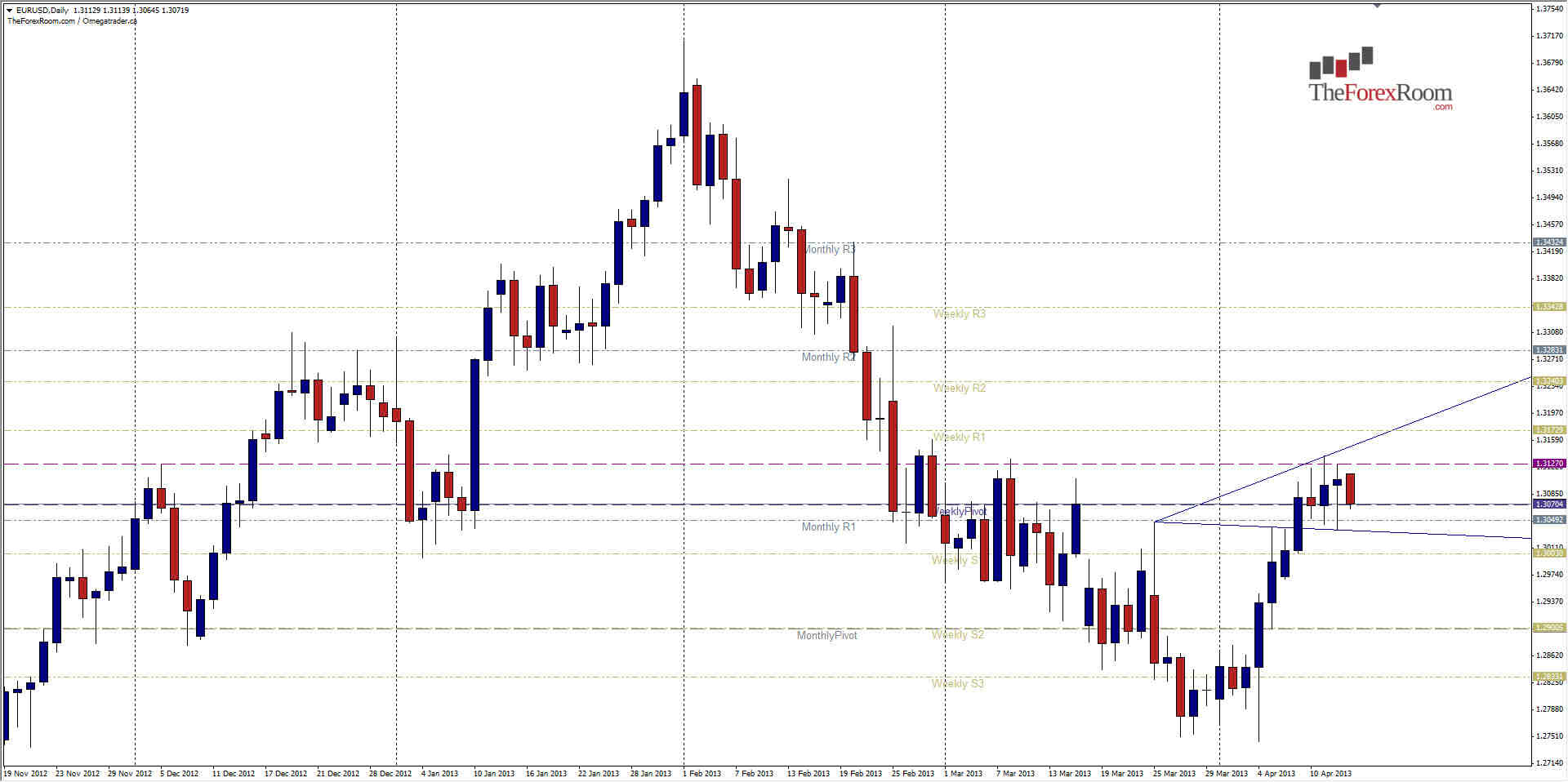

The EUR/USD is certainly under a lot of pressure fundamentally speaking. The Cyprus debt issue continues to weigh heavy on the currency, which has been impressively resilient so far. That said, it really is only a matter of time before the currency of the EU begins to tumble under the pressure and this could be that tipping point. Friday the pair printed a 'Hangman' formation on the daily chart as part of an expanding wedge pattern at a key resistance level of 1.3100. Although it might appear Bullish at first glance, the pattern actually suggests lower prices ahead and a break of Friday's low at 1.3036 will confirm a Bearish tone. After the break, support is seen at 1.3000 again, a psychological level in addition to being the Weekly S1. Below 1.3000 is a gap of another 100 pips or so down to the Monthly Pivot/Weekly S2 at 1.2900 on the way down to a possible retest of February's lows at 1.2750. If however we close above Thursday's High at 1.3137 the Bearish pattern will be nullified and we can expect at least a test of the resistance level from last December at 1.3173 before heading up to the Monthly R2 at 1.3283 and lows of January.

EUR/USD At Tipping Point Apr. 15, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- EUR/USD