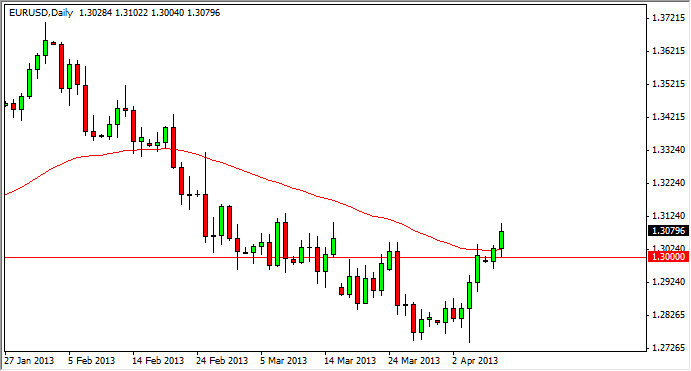

The EUR/USD pair had a strong showing during the Tuesday session, as we initially dipped down to the 1.30 level, but had plenty of buying at that area to push market higher. By the end of the session, we closed just below the 1.31 handle, and above the 50 day exponential moving average. With that being said, I am not ready to start buying the Euro quite yet, but I do recognize that a move above the 1.31 level will more than likely give the green light to go as high as 1.3250 in the short term.

The market is still relatively bearish, but it appears that we are suddenly forgetting about all the problems in Europe yet again. This is a pattern that we've been in for some time, where the markets will simply ignore everything that goes on in Europe, until they don't. At that point time, we would begin to sell off in the Euro and the European indices as well, and that has been the pattern over the last couple of years.

The risk is in Europe

The only thing the keeps his pair from falling off of a cliff is the fact that the Federal Reserve continues to engage in ridiculously high amounts of quantitative easing. Pay attention to the Federal Reserve, and you will find out where this pair goes eventually. Looking at this chart, I think that we will see a bump up in the near-term, and that we could conceivably go as high as 1.35 before it's all said and done. I would not expect the move much higher than that, simply because we are getting close to the quiet time of the year.

In fact, there is the old axiom "Sell in May, and go away." We may see this again this year as we have seen the selloff in late spring for the last three years in a row when it comes to risk assets. If that doe in fact happen, this pair will certainly be affected. In fact, that's essentially what I'm waiting to see happen, based upon higher levels that we presently see. In other words, I'm being very patient and looking to sell a couple of handles higher than we are right now.