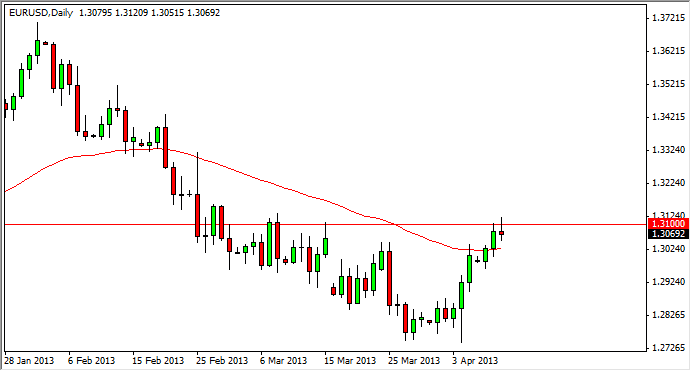

The EUR/USD pair cleared the 50 day exponential moving average just yesterday, but now we have a bearish signal. In fact, this is exactly where I would have anticipated it, assuming that we found ourselves falling back. The 1.31 level is an area that I find very resistive looking, and today's action certainly did nothing to dispel that idea.

The shooting star that had formed right before the gap down to roughly one month ago was based upon this level, and the fact that we found ourselves printing a shooting star on Wednesday certainly does little to change my outlook when it comes to this region. I believe that this is a technically important area, and it will determine the next couple hundred of pips.

Breaking of the bottom of Wednesday's candle would in fact be a very bearish sign, and send this market looking for lower levels. I don't necessarily think that the Euro is going to fall apart; what must be said is that these lower levels make more sense than going too much higher. After all, can anyone tell me exactly what Europe did to fix the problems?

Shooting star

The fact that we formed a shooting star is quite telling. If we get above the top of the shooting star, I see a clear path to the 1.3250 level in the short term. It also shows a significant break of resistance, which of course would bullish overall. However, the classic sense of technical analysis suggests that this shooting star is a sign of weakness, and it is in fact warming right where you would expect to see it. Because of this, I think that a pullback is coming, and the way the equity markets have been acting, I think we need it.

With all things being considered, the Euro has rallied significantly over the last four or five sessions, and knowledge day when the FMOC minutes had been leaked out to the press suggesting that quantitative easing in the United States may end sooner than expected, a run back into the US dollar wouldn't exactly be a stretch of the imagination.