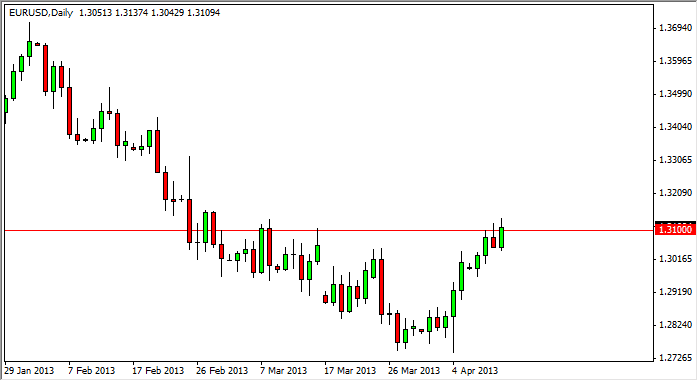

The EUR/USD pair went higher during the Thursday session, and actually managed to crack the 1.31 handle for the second day in a row. It should be stated that some of the gains were given back, and the breakout wasn't exactly impressive either. However, it is what it is, and we find ourselves above the 1.31 handle.

On a break of the highs from the session on Thursday, I believe that this market is heading towards the 1.3250 level. Beyond there, we could be looking at 1.33, and then 1.35 before it's all said and done. However, I have a hard time believing that the Euro will prove to be that appealing in the long run. Simply put, the Europeans have done absolutely nothing to fix their problems yet.

The Federal Reserve is Europe's only friend, or are they?

One of the most ironic things about this chart is that the Euro has continued to gain from time to time against the US dollar, and it is essentially because of the policies of the Federal Reserve. Simply put, I believe that if it weren't for the Federal Reserve and its massive quantitative easing programs, this pair certainly wouldn't be gaining. With the European Central Bank refusing to cut rates, this has people running to the Euro for some type of yield from time to time.

However, we are only one headline away from the Euro falling apart again. The question then remains “Where is the next fire?” I cannot help but think that sooner or later we will be talking about the Italian politics again, and possibly even the Italian banks. In other words, the next crisis is only a few minutes from now!

If we do manage to break down below that, I would suggest that a break of the 1.30 level would be a fairly bearish move. If we get down there, we should head down to the 1.28 handle relatively quick. If we manage to break that, we really could see the Euro selloff. However, I am more of the thought process that we are simply going above around for a while, and most certainly once the warmer months calm the traders will simply go on vacation and forget about this pair.