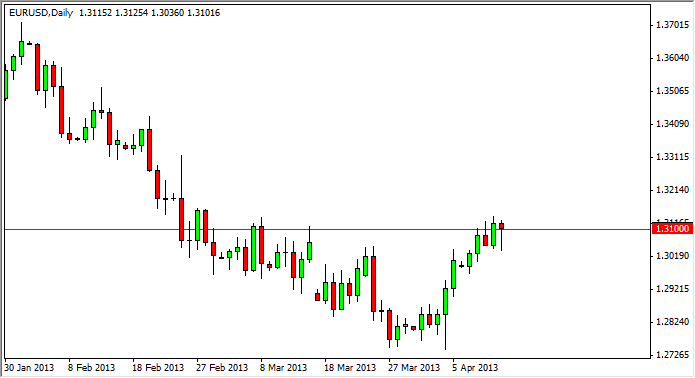

The EUR/USD pair fell during most of the session on Friday, but as you can see we got a bit of a bounce off of the 1.3025 region in order to form a hammer. What I find most interesting about this hammer is the fact that we closed just at the 1.31 handle, an area that had been so resistive lately. In other words, this could be the beginning of support for the Euro.

I think anybody that has read my articles of the past knows I have absolutely no time for the Euro itself, but I have to admit I do when the market looks like it's leaning in one direction. The fact that this hammer formed where it did does suggest to me that we will see the market tried to rally and perhaps head towards the 1.33 handle.

Because of this, I think that a break of the Thursday high, which is essentially the weekly high would suggest that it's a buy order could be placed. I think this is a short-term trade, as there are still plenty of problems in Cyprus, which by the way looks like it may be asking for more money and Italy which still has no actual governing coalition. In other words, there are simply far too many messy parts of the European Union to be involved with the currency for anything more than a short trade.

Federal Reserve

Quite frankly, if it weren't for the Federal Reserve and its easy monetary policies, I have a hard time believing that the Euro would be valued above 1.20 to the Dollar. In fact, this is more than likely by design as the central banks are all racing to see who can kill their currency the fastest. The "winner" ends up with a devalued currency that is better for an export led economy. However, there have been rumblings recently that some of the Federal Reserve members are starting to think that perhaps the time to slow down asset purchases may be coming sooner than the market anticipated. If that's the case, any gains that the Euro sees will be very limited. I still believe that we are only one bad headline away from losing 200 pips in this pair.