The EUR/USD pair had a negative tone to it on the Monday session, but quite frankly considering how drastically some of the risk assets out there sold off, it's not much to worry about if you happen to be bullish of the Euro. Obviously, if you have read any of my writings you know that I have no time for the Euro, but do sometimes by the currency based upon the charts. The recent action has made this pair very uninteresting to me, because it just simply didn't move.

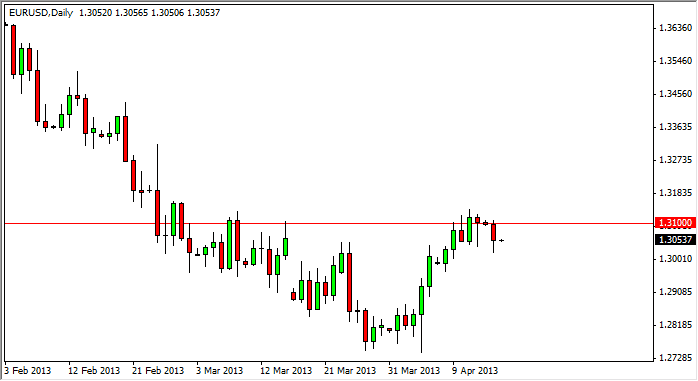

I see this pair is been stuck between the 1.30 and 1.31 levels, and as a result it is far too tight for me to be involved with. However, I do recognize various levels that would have me enter this market on both the long and short sides.

As for buying the Euro, I would like to see the market break above the 1.3150 level. I don't necessarily look for some type of massive move higher, quite the contrary. I think it that point time, we would be looking for the 1.33 handle in the short term, and would probably find a bit of resistance at that point. As for selling the Euro on a move below the 1.30 level, I think this market could selloff and head towards the 1.27 level over the near-term.

Messy

For me, this pair is just simply messy at this point in time. There are so many things going on in Europe right now that could add to the headline risk, it is almost impossible to trade this currency pair sometimes. There are still current issues in Italy to worry about, and Cyprus is rumored to be talking about needing more money. If that's the case, we could see more volatility in the Euro. With that being the case, I really haven't please much in the way of trade in this pair recently, and quite frankly am fine if I don't. However, I do have those parameters to look at and would be interested in trading both of them.