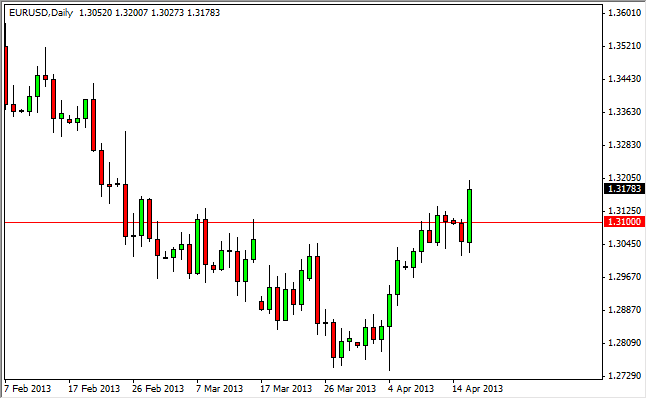

The EUR/USD pair had a strong showing on Tuesday as the 1.31 level was broken to the upside. This market continues to show strength as we have seen over the last couple weeks, and the fact that we managed to pierce the 1.33 level suggests that there is a bit of underlying strength in this marketplace. I had originally been looking for a move above the 1.33 level in order to start buying, but now that we have seen essentially the same thing done, although we did close above it - I think that a break of the highs from the Tuesday session is a very bullish sign, and enough to get me buying.

I also think that the 1.33 level will more than likely offer a bit of resistance, and as a result this is more or less going to be a short-term trade. Whether or not we can get above 1.33 is a completely different question altogether, as I see quite a bit of choppiness all the way to the 1.35 handle.

Looking forward, I would expect to see a move to the 1.33 handle based upon the candle that I saw on Tuesday. After all, the Euro did breakout of a significant resistance area, and it does tend to go higher all things being equal. The US Dollar Index also broke down a bit during the session on Tuesday, and this of course suggests that we are going to see Dollar weakness. This particular pair is 40% of that contract, so this is by far the easiest way to validate that weakness. All things being equal, I think this pair will see the most "damage" to the Dollar.

Monetary policy

Even though Europe as an absolutely wrecked banking system at this point, the fact is that the trading world is overlooking it yet again. This is essentially what this pair has become, a measurement of which side of the Atlantic traders are focusing on. Wherever the focus, that particular currency does poorly. They are obviously not paying attention to the continent right now.