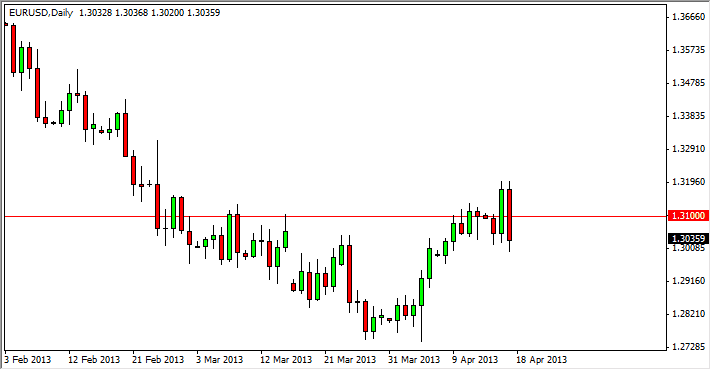

The EUR/USD pair had a very negative session on Wednesday, as we continue to flood around the 1.31 handle. In fact, at one point time we put a serious attack on the 1.30 handle, an area that I think would lead to lower prices if we can break down below it on a daily close. We didn't do that, so while I did miss that we have a sell signal yet, I do think that if we managed to break down below the bottom of the range for the Wednesday session, that's probably close enough and I would consider selling.

However, looking at this chart it looks like we are disciplined trying to figure out which way to go. If that's the case then we could expect to see quite a bit of consolidation in this general vicinity. This could be choppy trading action for the near-term, which isn't much of a surprise considering this pair has basically been exactly that for the last year and a half. Even when we trend, it's been a bit of a fight in both directions.

Headline risk

This pair without a doubt is going to be one of the ones that are most sensitive to headline risk around the world. This is especially true when you think about the European banking crisis, however essentially hasn't been fixed at all, it seems like we keep "whistling past the graveyard." Sooner or later, we will have to deal with this particular situation, but in the meantime it seems like the market is satisfied by simple lip service from time to time.

This candle is technically a "double high, low close" set up, meaning that we popped out at the exact same price above candles, and then eventually turned around and close lower than the bottom of the first one. This is a relative signal, but considering that we are sitting just above support is a bit difficult to make much out of it. However, I will admit that I am pretty negative on the Euro in general, and it should be noted that the US Dollar Index looks very strong after the session as well. Again, on a break of the lows from the Wednesday session, I'm selling this pair.