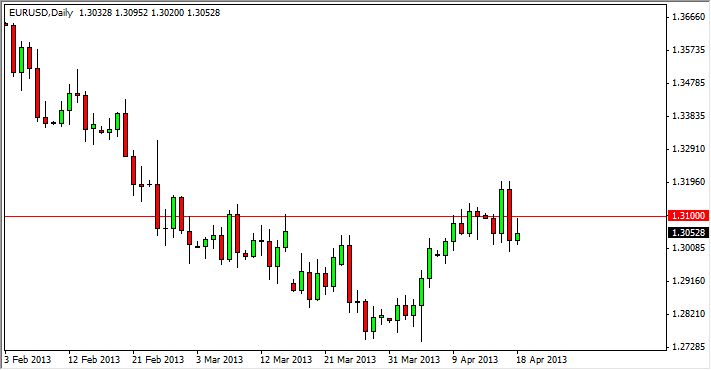

The EUR/USD pair rallied during the session on Thursday, but as you can see on this chart sell at the 1.31 handle, showing that we are starting to lose a little bit of momentum in this market. With that being said, we could start to see a selloff but the 1.30 level will have to be overtaken by the sellers first in order for this to truly happen. The shape of the candle is a shooting star, and a shooting star at the bottom of a recent move is continuation, not necessarily exhaustion.

It does show though that the buyers have given way to the sellers, and now it only needs a little bit of pressure to the downside in order to start falling. There are plenty of reasons to think why the European Union could have negative headlines of the next couple of days the push the price of the Euro down, so think that this pair would fall would exactly be a real stretch of the imagination to me.

Daily close below 1.30

I will be watching for a daily close below the 1.30 handle in order to start selling, but I think that the pair probably won't fall more than 200 pips or so in order to continue with the sideways grind that we have seen recently. A meltdown is highly unlikely, basically because the Euro always seems to find another reason the standup. Going forward, I fully expect to see more weakness, but one must be very careful trading this currency pair, because it is basically being traded upon headlines at the moment, and as a result it can act very erratic.

As far as buying is concerned, if we managed to get above the 1.3200 level, I would consider buying at that point as it would show a real breakout to the upside. However, I would expect this market go much higher than 1.35 from a move like that, and as a result have less interest taking that trade that I do shorting the market in going with the overall trend.