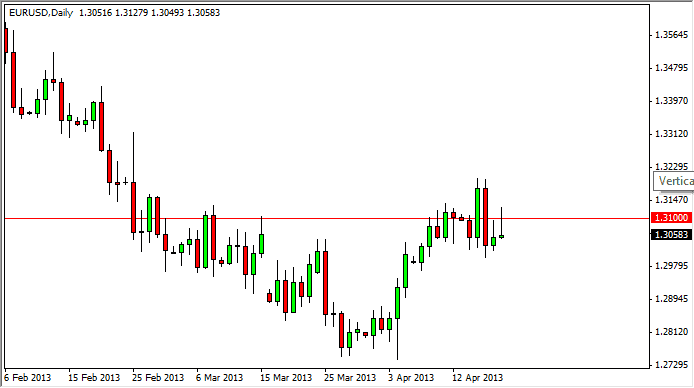

The EUR/USD pair tried to rally during the session on Friday, which you can see that the 1.31 level offered too much resistance for the second day in a row. Because of this, we have formed the second shooting star in a row, which of course is a very bearish sign. With that in mind, I think we managed to break down below the 1.30 level this pair could start to grind much lower.

However, we have to keep in mind that this is the Euro that we are talking about, which of course seems to have nine lives. All things being equal, I don't expect some type of meltdown, rather that we will grind around between 1.31 and 1.28 or so. With that being the case, I deftly favor the downside at this moment, but I realize that we may be entering the Viper consolidative range.

Headlines still are the biggest enemy for the Euro, and there will be plenty of them over the next couple of weeks. There are still plenty of issues in Italy, as there is no governing coalition, as well as several of the peripheral countries. The peripheral countries all have problems with their debt, and of course this is been known for quite some time. However, Europe seems to get a pass every once in a while, and we may be ending its latest reprieve.

Will the markets demand Europeans get it together again?

It appears the markets may be focusing on the troubles in Europe again, and if that's the case there will be the usual pressing of the Europeans bond markets and spread flying out for a short amount of time, driving this pair lower. However, I am fully confident that things will turn back around after a few handles, we'll find ourselves wondering why the Euro is going higher.

At the end of the day I think we are trying to find some type of range to start trading in the summer months for. Right now, I think that's basically 1.32 on the upside, and 1.2750 on the down.